The US remains a leading destination for ICO projects according to a new study that also ranks Switzerland and Singapore in the top three. The report notes that authorities in other jurisdictions, like Russia and Estonia, are working to adopt favorable regulations in order to attract more crypto startups. The findings coincide with another study identifying 78% of all ICOs as scams.

Also read: Less Than Half of ICOs Survive Four Months After Sale, Study Finds

A Third of the Largest ICOs Held in the US

Despite regulatory uncertainty, the United States has established itself as the leading destination for companies conducting Initial Coin Offerings (ICOs), a new study confirms. According to the recently published report, 30 of the 100 largest token sales were held by companies based in the US. The data compiled by the team of the Crypto Finance Conference places Switzerland second with 15 ICOs, and Singapore third with 11 of the biggest coin offerings.

“ICOs continue to gain momentum. They raised $6.3 billion in the first quarter of 2018 — more than was raised in all of 2017,” said the chief executive of CFC, Andrea-Franco Stöhr, quoted by Venture Beat. In a released statement, he also commented that the research provides an opportunity to understand which countries are embracing blockchain and crypto projects and how they do it.

The authors of the study also note that a number of countries are making efforts to adopt and implement regulations that would attract and encourage more initial coin offerings. The Russian Federation, which hosted six of the top 100 projects, is one of them. Another report published earlier this year claimed that startups with Russian participation raised $310 million. That study covered a total of 370 token sales.

The other nation that has been mentioned in the study as a crypto-friendly jurisdiction is Estonia, with four of the largest ICOs. According to some reports, the tiny Baltic country accounts for up to 10% of all funds raised through initial coin offerings last year.

78% of ICO Projects Identified as Scams

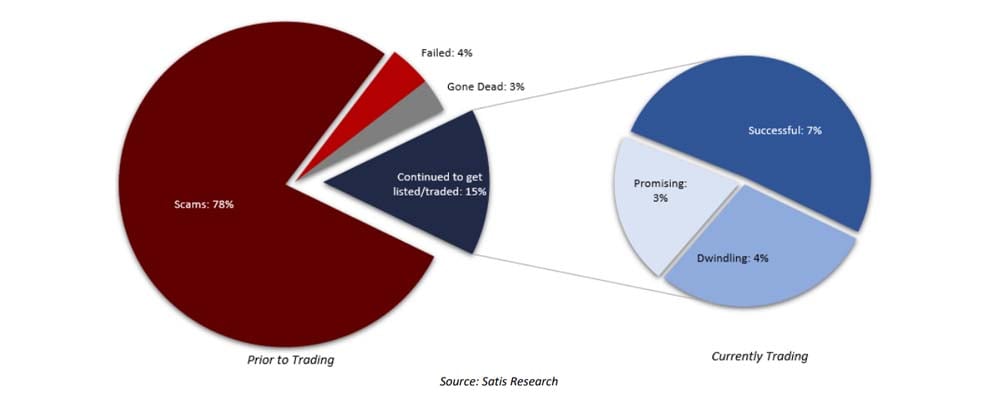

Despite two recent studies suggesting investors are still bullish on ICOs, a research conducted by the Boston College revealed that less than half of ICOs survive four months after sale. Now, another study, authored by the research company Satis Group, tells us that a staggering 78% of all coin offerings conducted last year have turned out to be scams. These ICOs promised big profits but shared very little information about the project and the team behind it or didn’t even publish a white paper. Most of them disappeared right after the token sale.

The updated data in the “Cryptoasset Market Coverage Initiation: Network Creation” report, released last week, also shows that 4% of the ICO projects have failed to meet their fundraising targets and have returned the capital to the investors. Another 3% were never listed on a trading platform. Only 15% of the coins sold through ICOs continued to be listed and traded on exchanges. Of those currently trading, 7% are deemed ‘successful’, 3% are said to be ‘promising’, and 4% are tagged ‘dwindling’.

It’s been estimated that of the $12 billion raised by ICOs, $1.3 billion (11%) was lost to scams, $1.7 billion (14%) disappeared in failed projects, and $624 million (5%) went to those that had gone dead. However, more than 70%, or $8 billion USD, went to ICOs that eventually reached exchanges. According to the study, most of the funds appropriated by scams were invested in three projects. These are Pincoin ($660 million), Arisebank ($600 million) and Savedroid ($50 million).

Do you think the regulatory efforts in many jurisdictions will decrease the number of fraudulent ICOs? Share your expectations in the comments section below.

Images courtesy of Shutterstock, Satis Group.

Now live, Satoshi Pulse. A comprehensive, real-time listing of the cryptocurrency market. View prices, charts, transaction volumes, and more for the top 500 cryptocurrencies trading today.

The post US Ranked Top Destination for Coin Offerings, Majority of ICOs Identified as Scams appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube