I’m strongly considering entering into a substantial investment in bitcoin as part of my passively managed, fully long portfolio. Before I do that, I decided to look into two questions regarding bitcoin’s role in a portfolio:

- What is bitcoin’s correlation with other financial assets?

- Can exposure to bitcoin be replicated using a combination of existing financial assets?

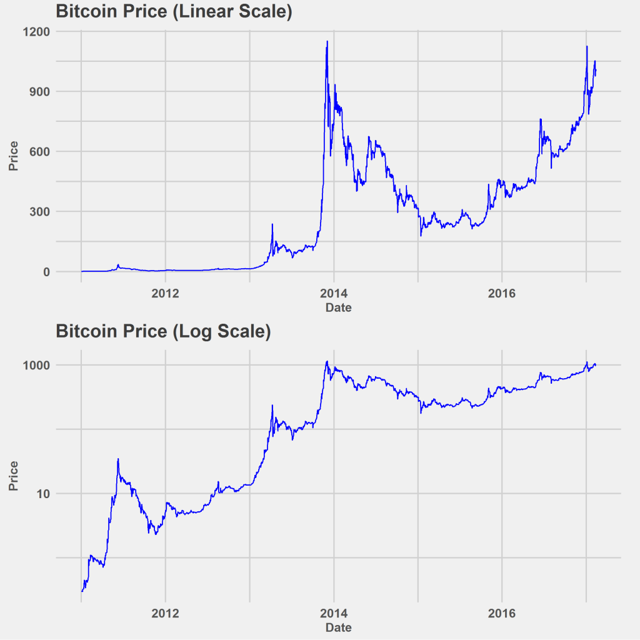

My reasoning was that, if possible, it would be preferable to replicate exposure to bitcoin using existing financial assets because there are still substantial risks to owning bitcoin. First, a plot of bitcoin’s price in both a linear and log scale to place the following analysis in context.

Can Bitcoin Be Considered a Financial Asset?

Before calculating bitcoin’s correlation to other financial assets, it’s useful to take a step back and think of whether bitcoin can be considered a financial asset based on its fundamental characteristics. And if bitcoin is a financial asset, how should it be classified?

A useful framework for thinking about this is in Robert J. Greer’s paper, “What is an Asset Class, Anyway?” In this paper, Greer defines an asset class as “a set of assets that bear some fundamental economic similarities to each other, and that have characteristics that make them distinct from other assets that are not part of that class.”

He proposes that any asset can be classified into one of three super classes:

- Capital assets. Capital assets are any assets that can generate future cash flows, such as equities which generate cash flows in the form of dividends and bonds which generate cash flows in the form of coupon and principle payments. The defining characteristic is that capital assets can be reasonably valued by discounting future cash flows to the present and therefore are sensitive to changes in the discount rate.

- Consumable transformable assets. These assets can be consumed or transformed into another asset but do not have the ability to generate future cash flows by themselves. In other words, physical commodities. Consumable transformable assets are distinct from capital assets in that they cannot be valued by discounting future cash flows to the present. Instead, an analysis of the asset’s supply and demand characteristics is more appropriate.

- Store of value assets. It doesn’t generate income, and you can’t consume it, and yet it has economic value. These are assets that are worth something precisely because other humans have also agreed that it’s worth something. Currencies and collectibles are examples of store of value assets.

In the real world, not every asset falls neatly into one of the three categories. Gold, for example, is both a consumable asset and a store of value asset. It’s arguable that U.S. sovereign bonds are both a capital asset and a store of value asset. But it’s still a useful framework to keep in mind when thinking about portfolio construction.

Where does bitcoin fall in this framework? Bitcoin can be safely categorized as a store of value asset in that it doesn’t generate income, you can’t consume it, and yet it has economic value. Store of value assets are often referred to by other names, including “safe haven assets” and “flight to safety assets”. Thus, we should expect a priori that bitcoin should have a higher correlation to other store of value assets, including gold, other precious metals, and safe haven currencies like the Swiss franc, U.S. dollar, and Japanese yen.

Testing Bitcoin’s Correlation Using the Brute Force Approach

In the past few years, ETF offerings have become sufficiently broad to represent virtually all asset classes across all major countries and geographies. ETF historical prices therefore represent a fairly high-quality source of asset returns. I wrote about how to obtain this data in a previous post: How to Scrape Data for Over 1,900 ETFs.

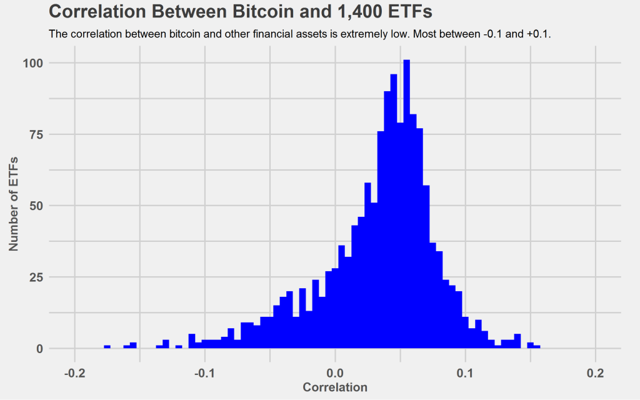

I first tested bitcoin’s correlation to other financial assets using what I call the brute force approach: I calculate the correlation between bitcoin’s weekly return and the weekly return of all ETFs with over $10 million in assets and plot the results in the following histogram.

The interpretation is that the correlation between bitcoin and other financial assets is extremely low. Most asset classes have a correlation between -0.1 and +0.1. The few ETFs with correlations outside of this range were mainly explained by the fact that some ETFs were launched recently and thus the correlation between bitcoin and these ETFs were largely spurious in nature.

This result was a bit disappointing since I was originally hoping to replicate bitcoin’s exposure using a collection of highly correlated ETFs. On the other hand, this is a strong argument for including bitcoin as a significant part of a portfolio of risky assets. Finding and adding an uncorrelated asset to a portfolio can act as a powerful source of diversification by increasing the portfolio’s sharpe ratio. There are extremely few assets that are this uncorrelated with other assets and that makes bitcoin extremely desirable from a portfolio construction perspective.

Testing Bitcoin’s Correlation Using the Refined Approach

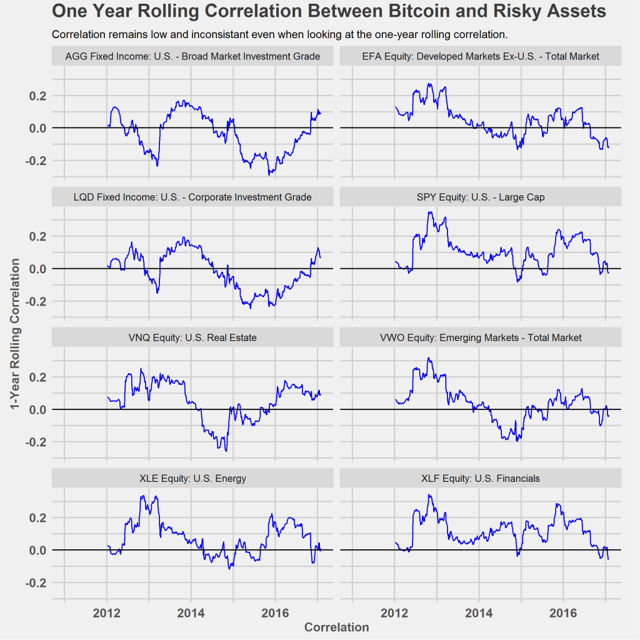

I decided to look into bitcoin’s correlation further using a refined approach by calculating the one year rolling correlation between bitcoin’s weekly returns and the weekly returns of selected ETFs. There is evidence that bitcoin has become a more mature asset class over time in that its volatility has reduced and it has started to react more to macroeconomic factors and geopolitical events rather than things that are specific to bitcoin itself.

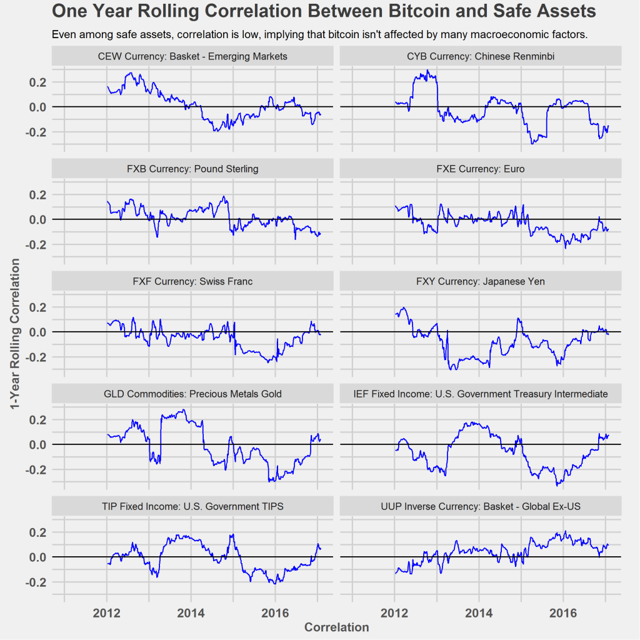

Below I plot of the one year rolling correlation between bitcoin’s weekly returns and the weekly returns of a selection of risky assets followed by a plot of a selection of safe assets.

The interpretation is that even looking at a one year rolling window, the correlation remains low with many correlations oscillating between positive and negative. Current correlation is still low even though bitcoin has had time to mature into a legitimate asset class.

Remember, I had expected a priori that bitcoin would have a higher correlation to these safe, store of value assets. Originally, I had hoped to replicate bitcoin exposure using a combination of gold, US sovereign bonds, and foreign currencies. These results strongly suggest that this is not possible and that bitcoin is a unique, uncorrelated asset class that is not strongly affected by the macroeconomic factors that drive most asset classes.

Doing this analysis has given me conviction that bitcoin should be a part of my passively held, long only portfolio. First, there aren’t that many store of value assets in the first place. There’s gold, US sovereign debt, safe haven currencies, and that’s it. Second, it’s surprising that bitcoin’s correlation is this low, even among other store of value assets.

At the same time, there are strong theoretical arguments that bitcoin will serve as a hedge against harmful geopolitical events due to its decentralized nature. There’s a growing body of empirical evidence of this also with bitcoin price spiking in response to both Brexit and Donald Trump’s win.

Bitcoin is uniquely positioned to hedge against geopolitical risks but remain unaffected by the macroeconomic factors that drive other store of value assets.

Exposure to bitcoin can be obtained either by buying bitcoin directly, through the upcoming bitcoin ETF (Pending:COIN), or the Bitcoin Investment Trust (OTCQX:GBTC).

The code for this post can be found on my Github.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube