What is CRYPTO20?

CRYPTO20 (C20) is the world’s first cryptocurrency tokenized index fund, allowing investors to get the diversification benefits of holding the market’s top twenty cryptocurrencies with the ease and simplicity of holding a single token.

Less than a decade old, the cryptocurrency market is still early in its lifecycle relative to other asset classes. At a total market cap of almost 500 billion dollars, the cryptocurrency market stands only a fraction of the size of the world’s largest financial markets and still has adequate room to grow.

C20 offers investors a practical, low-cost method to adequately track the general return of the quickly growing digital asset market.

Overview of CRYPTO20’s Benefits

CRYPTO20 offers investors multiple benefits that are unmatched by other market products:

- Diversification – Allows investors to easily diversify their exposure among the top 20 cryptocurrencies by market cap. Adequately gives users a viable method to bet on the future of the entire cryptocurrency market.

- Low Fees – Offers the industry’s most competitive management rates as C20 relies on data science to power the portfolio’s rebalancing features.

- Convenience – Provides consumers an incredibly easy way to invest in multiple digital assets without the need to create several accounts or wallet types.

- Transparency – Gives token holders full transparency over fund activity as all fund actions are recorded and inspectable on Etheruem’s blockchain.

- Liquidity – Created with a built-in liquidity smart contract option, C20 token holder’s have the option to liquidate their tokens anytime.

- No Minimum Investment – With no minimum capital requirement, C20 provides all investors a method to track the return of the cryptocurrency market.

CYRPTO20’s Current Portfolio

As of February 14th, 2018, CRYPTO20’s portfolio consists of:

- Ripple- 9.8%

- Bitcoin- 9.6%

- Ethereum- 9.6%

- Bitcoin Cash- 9.5%

- Litecoin- 9.1%

- Cardano- 7.7%

- Stellar- 6.1%

- Neo – 5.9%

- EOS – 4.7%

- Iota- 4.1%

- Dash- 3.9%

- NEM- 3.6%

- Monero- 3.1%

- Lisk- 2.6%

- Ethereum Classic- 2.4%

- Tron- 2.1%

- Qtum- 1.8%

- VeChain- 1.7%

- Bitcoin Gold- 1.5%

- Populous- 1.2%

To see key information about C20’s portfolio, head over to its performance portal.

CRYPTO20 Basics

Launched October 16th, 2017, C20 tracks the top twenty cryptocurrencies by market cap. The index uses a max component weight of 10% per asset so a single holding cannot dominate the fund.

A closed-end fund, C20 raised funds once through an ICO and capped the total number of tokens created at 40,656,082. With a circulating supply of 39,335,007 tokens, C20’s fund value totals at $86,359,404. C20 tokens are non-mineable.

C20 is a passively managed fund; fund managers do not engage in active trading apart from the weekly rebalancing of assets. CRYPTO20 plans to utilize machine learning to optimize fund management and determine the parameters for future funds.

Managment Fees

By cutting out middlemen and automating weekly rebalancing mechanisms, C20 can offer one the industry’s most competitive management fee schedules.

C20 has a flat annual fixed fee of 0.50% whereas competing crypto funds have management fees around 3%. There are no exit fees, no brokerage fees, and no advice fees.

Buying and Selling C20

C20 tokens are exclusively bought and sold on select cryptocurrency exchanges.

Where is C20 Traded?

C20 is currently listed on four exchanges:

- Bibox

- HitBTC

- IDEX

- EtherDelta

C20 is also currently in the process of being accepted to Coinexchange and YoBit.

Token Holder Options

A C20 token holder has two different options to receive payment when disposing of a token:

- Sell C20 on an exchange

- Use C20’s built-in liquidation option

Liquidation Option

C20 has a built-in smart contract liquidation function that enables investors to withdraw Ethereum based on their share of the fund’s underlying assets. There’s no authorization or waiting time needed to liquidate tokens in this manner.

To liquidate your position, you must submit a withdrawal request to the smart contract. The smart contract then allows you to withdraw an Ethereum amount that’s equivalent to the market value of all the investor’s tokens. There’s a 1% trading fee for activating this liquidation option.

If a token is liquidated, it’s sent back to the CRYPTO20 Managment team who will then resell the token on an exchange at the token’s current market value. This ensures that liquidated tokens stay in circulation and overall token supply doesn’t decrease after a liquidation event.

Pricing

This liquidation option creates an effective price floor that ensures C20 tokens should never trade at a discount below the token’s net asset value (NAV).

Token NAV = Net Asset Value of Fund/Circulating Number of tokens

C20’s token value can exceed the value of underlying assets (traded at a premium) but can not fall below the value of underlying assets (traded at a discount) due to the liquidation option in the smart contract.

C20 ICO

C20’s public ICO was held from October 16th, 2018 to November 30th, 2017. The fund raised a total of $38,000,000 during this period. No further tokens will be created past the ICO.

ICO Token Pricing

- Pre-sale price for 1 week before: $0.95

- Pre-sale price up to first 48 hours of ICO: $1.00

- Price past first 48 hours to end of 3rd week of ICO: $1.05

- Price from 4th week to 6th week of ICO: $1.10

ICO Token Distribution

- ICO Participants – 87.0%

- C20 Team* – 7.5%

- Marketing and Investor Relations – 2.5%

- Legal – 1.0%

- System Security Team – 1.0%

- Bounty Program – 0.5%

- Advisory Team – 0.5%

*C20’s team tokens will vest over a two year period to ensure that the team’s incentives are aligned with ICO participants.

Fund Performance

During C20’s ICO, tokens were sold in the price range of $0.95 to $1.10 depending on when exactly the tokens were sold. As of February 14th, 2018, ICO participants have been rewarded with a return over 100% regardless of what point they bought during the ICO. Since C20 became listed on exchanges in late January, its price has fallen to $2.43 as the value of its underlying assets has declined.

How to Store C20

C20 is a standard ERC-20 token. Therefore, C20 must be stored in an ERC-20 compliant Ethereum wallet. A popular software wallet choice is MyEtherWallet.

To eliminate third-party security risks, investors should consider storing their digital assets in a hardware wallet. Some well trusted ERC-20 hardware include Ledger Nano S or Trezor.

Partners List

CRYPTO20 has an extensive list of over ten partners:

- Block512 – Block512 is a platform agnostic consortium of experts providing insights, advisory, and acceleration services for blockchain solutions with viable business models.

- Danilov & Konradi LLP – Danilov & Konradi LLP is a boutique international law firm based in Moscow and Texas.

- The 8760 – The 8760 is a full stack marketing agency, specializing in deep Fintech, blockchain, and ICOs.

- HoSho – HoSho is a global leader in blockchain security. Security services include static analysis, contract verification, solidity developments among other things.

- Extravaganza – Extravaganza is an international digital marketer and software development agency that offers a variety of digital services.

- Coinhills – Coinhills is a website that aggregates cryptocurrency market data as well digital asset news from across the web.

- DataProphet – DataProphet specializes in machine learning and provides product development services to a wide range industry from finance to legal.

- KR Token – KR Token offers a variety of services that include token sales, OTC trading for digital assets, and cryptocurrency asset management.

- Securrency – Securrency is a combined FinTech/RegTech platform that enables the free trading of previously illiquid asset classes.

- Metamension – MetamensionA digital marketing firm that specializes in video and art creation for film and television.

- IdentityMind – IdentityMind builds trusted digital identities to streamline compliance and enhance fraud prevention.

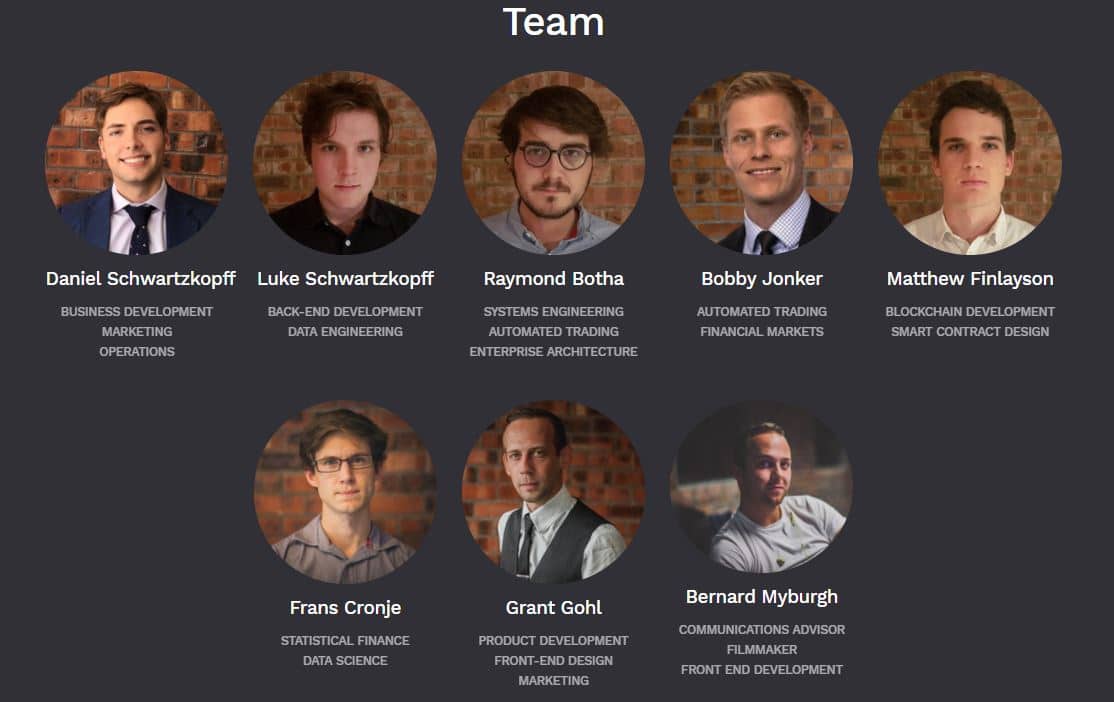

CRYPTO20 Team

C20 is lead by its founder and CEO, Daniel Schwartzkopff. He’s a serial entrepreneur with a background in start-up, technology, and social networking development. Additionally, Schwartzkopff is the co-founder and director of Dataprophet, a machine learning consulting and development firm.

Some other key team members include Raymond Botha and Bobby Jonker. As co-founder and CTO of C20, Botha manages system engineering and architecture for the project. Botha also contributes to the fund’s blockchain integration and automated trading system. As the C20’s fund manager, Jonker handles business operations of the fund. Jonker’s financial experience includes work experience at Intertrust Group, PricewaterhouseCoopers, and Ernst & Young.

Conclusion

Investing in individual crypto investments is inherently risky and requires the burden of time-consuming research; CRYPTO20 offers investors a practical investment strategy that mitigates overall investment risk by creating an index that tracks the emerging cryptocurrency market as a whole rather than attempting to hand-select the market’s winners and losers.

For more information, navigate over to C20’s website or whitepaper.

The post What is CRYPTO20 (C20)? | Beginner’s Guide appeared first on CoinCentral.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube