In a perfect world, money would never fall out of your wallet. Your debit card PIN would never be stolen – at the gas station on an anniversary trip. Your bank account would never be hacked. And the gift card – that you received as a gift for your birthday – would never lose its value due to gift card fraud.

This world is far from perfect.

However, amongst this imperfection, Zeex (with an X), a sister company of the known Zeek (with a K), has developed a solution that allows you to store and manage many of your cash assets in one secure location, offering unique security, privacy, and ease of use.

Evolution and Complexity of Payment

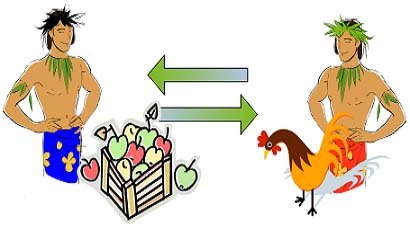

Over the years, money, and payment systems in general, have evolved. The beginnings of money, including who invented it and when, are uncertain. Barter – the exchange of goods or services – was the original exchange. History suggests that the first established “currency” consisted of livestock, grains, and eventually seashells. These systems would have its own challenges. For example, barley, as a bulk item, theft was likely, quality factored into value, and of course, everything depended upon basic and uncontrollable factors – like the weather.

As early as 700 B.C., the first coins were minted, either by non-Greek Lydians or possibly Greek mercenaries. Next up came bank notes, which were initially the brainchild of the Chinese around 1000 A.D, give or take a few centuries. Bank notes, or cash money, apparently worked very well in China. However, when the idea was introduced to Europe around 1650 A.D. via Stockholm’s Banco, inflation happened so quickly that within a decade, the entire bank collapsed.

Despite innovations like the gold standard (and it’s replacement – simple trust in the federal reserve), checks, and credit cards, humanity has never quite perfected this system. But over the past 50 years, the evolution of money exchange has gone into overdrive. We have moved from checks, to credit cards, to the conceptualization and subsequent distribution of cryptocurrency.

Image source: studypoints.blogspot.co.il

Through all these changes and the benefits that credit cards and gift cards offer, many of the same security threats remain. Money is misplaced. It is damaged. And of course, it is stolen. Digital currency typically offers a bit more privacy, and quite a bit more security, but delivers a blow to accessibility.

While credit cards, gift cards, electronic checks offer flexibility, they still operate with a great deal of risk. Thankfully, the 21st century and the implementation of cryptography into digital currency brought a solution. Cryptocurrency could solve all manner of theft, ownership, double spending, and other risks, and it could do it very easily. It has value, as evidenced by the ongoing demand for Bitcoin; despite massive fluctuations, Bitcoin continues to retain value. However, cryptocurrency lacks an efficient method for spending and currency exchange. A Bitcoin key cannot be used to purchase groceries or make a car payment. A possible explanation for this has been presented by cryptocurrency blogger Christopher Georgen, who states that until Bitcoin or other cryptocurrencies can be used as a medium of exchange, a storage of value, and unit of account, there will be little stability to any blockchain based unit of currency.

Solving Complexity with Elegant Simplicity

According to CEB TowerGroup, an estimated 1 billion dollars is lost annually in gifts cards. The founders of gift card marketplace Zeek (with a K) learned this the hard way by losing a large amount of cash when a cash voucher expired. This experience led them to research the issue, make a plan, and implement a viable solution. Zeek identified that gift card, or corporate currency, use is on the rise, especially among millennials, due to the security and savings it offers, and helped expand the marketplace. They are now a reputable, secure source in the digital and corporate currency marketplace.

Zeex (with an X), the spinoff from Zeek, is also seeking to solve the inaccessibility of cryptocurrency as compared to fiat money and corporate currency. Zeex is using the existing reputation of its sister company, developed a solution to the exchange of currency aspect. By making cryptocurrency interchangeable with corporate currency, cryptocurrency is now a viable way to purchase goods and services. Conversely, the relationship Zeex has developed between the two markets has increased the privacy of centralized currency, utilizing one of the strongest pieces of the blockchain to strengthen that existing market.

Zeex’s platform converts cryptocurrency to corporate currency in an efficient, cost-effective way, making cryptocurrency a viable way to make purchases for the very first time. The smart contracts Zeex is based on accomplishes this by eliminating risk through the transfer process, monitoring transaction types and values, and creating a login system based on the blockchain itself.

It’s clear that certain risks associated with money have never been overcome. However, the Zeex platform, which combines the security of cryptocurrency with the accessibility of corporate currency, utilizes cryptocurrency to solve not only historical challenges like theft, inflation, and double spending, but also the new issues inherent to cryptocurrency, specifically accessibility, opening the door to an exciting time in the history of money.

Do you think that Zeex will make it easier for people to pay for purchases using cryptocurrency? Can it help foster more widespread crypto adoption? Tell us what you think in the comments below.

Images courtesy of Zeex

The post Will This Blockchain Based Startup Pave the Way for Cryptocurrency Usage? appeared first on Bitcoinist.com.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube