The cryptocurrency debit card issuer Wirex became the third blockchain-based platform to receive an e-money license from UK’s Financial Conduct Authority (FCA). This license gives the company a wide-array of new capabilities. Among these new functionalities include access to traditional banking services.

The FCA is responsible for determining financial regulations in the UK. In the past, the authority grappled with the concept of cryptocurrencies. On more than one occasion, the FCA expressed concerns about scams in the crypto space. The e-money license showcases a more balanced approach towards the cryptosphere.

The news puts Wirex in an exclusive class, which includes the group behind Coinbase, North America’s largest exchange. Coinbase developers needed to receive FCA approval because their exchange handles fiat-to-crypto exchanges. Wirex’s platform incorporates many of the same functionalities as the Coinbase exchange. These functions include the ability to exchange Bitcoin, altcoins, and fiat currency directly.

Company executives stated that the licensing would not affect the operation of the platform in any way. The main difference will come in the form of lower trading rates for customers exchanging fiat into cryptocurrency.

Wirex

Wirex officials registered for the license in 2017. According to company executives, the approval process lasted nine months. The e-money license allows Wirex to directly integrate their services with traditional banking operations. The company can now offer customers the ability to convert fiat into cryptocurrency directly within the platform.

Wirex Virtual Card

The Wirex virtual card is a prepaid cryptocurrency card that automatically converts funds into fiat currency during use. For example, a Wirex virtual cardholder loads their card with one of 50 supported cryptocurrencies. It’s free to load the card, and you can transfer funds directly from your bank account to purchase crypto.

These loaded funds remain as crypto until the moment you swipe your prepaid debit card. At that moment, the platform automatically exchanges the corresponding amount of crypto into fiat currency and pays the vendor.

Wirex Visa debit card via The Coinage Times

Wirex card users earn 0.05 percent in Bitcoin every time they use their Wirex Visa card to make purchases. You can instantly redeem, convert, and spend these crypto earnings all from within the platform. Crypto debit cards have become more popular over the last year, and Wirex isn’t the only platform in the space utilizing this method of instant conversion. This strategy provides you with the ability to spend your crypto as easily as fiat currency, and many in the space see these functions as a critical step towards increased adoption.

Crypto App

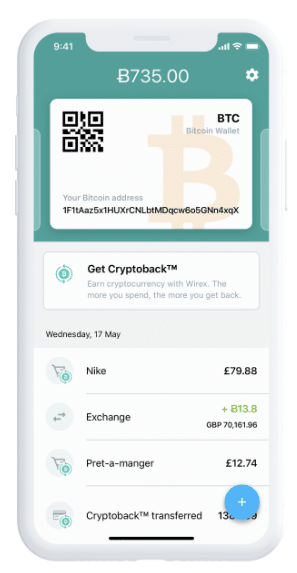

The Wirex crypto app allows you to buy, store, exchange, and spend crypto directly from your Apple or Android-powered smart device. You can send money to other app users, globally, for free. This comprehensive approach to the crypto space provides Wirex users with a more robust crypto experience. The Wirex wallet currently shows over 500,000 downloads in the Google Play store. The App has a four-star ranking with over 6,000 reviews.

Wirex mobile app via Homepage

W-Pay Wirex Payment Network

The Wirex payment network is a multi-asset off-chain liquidity network. The network enables near-instant global payments through the use of smart contracts. Developers cited Bitcoin’s Lightning Network as the main inspiration behind the concept. The W-Pay platform is the first mass consumer service to successfully integrate cryptocurrency blockchains with traditional banking services, most notably, VISA.

Wirex AML/KYC

The Wirex platform gained their e-money license by adhering to the strict know your customer (KYC) and anti-money laundering (AML) laws. These protocols require that every user prove their true identity. KYC and AML laws are universal in the traditional banking sector. Now, cryptocurrency users find themselves facing the same legal requirements for a growing number of blockchain-based platforms.

Company History

Wirex entered the market in 2014. The platform’s original name was E-coin. The firm saw immediate success, and by 2017, the company had a staff of over one hundred specialists. Wirex gained additional traction in the market after successfully raising over $200,000 on the BnkToTheFuture platform.

In 2017, Wirex achieved another fundraising victory after securing $3 million in Series A funding from one of Japan’s largest financial institutions, SBI Group. The SBI group is no stranger to blockchain technology, and the firm already has partnerships with Ripple, BitPesa, and PrimeChain technologies.

Wirex Company Party via Website

Wirex has offices in London, Tokyo, Delaware, Singapore, Kiev, and Toronto. The virtual currency wallet provider provided services to over 900,000 users globally in 2017. The same year, the platform completed over $1 billion in transaction volume. The platform is hugely popular, with services offered in 130 countries.

FCA Crypto Programs

To better understand the ever-growing FinTech sector, the FCA decided to open a crypto regulatory sandbox. Companies requested access to be a part of the program, and if approved, the FCA helps the companies meet their stringent requirements. According to the firm’s website, the FCA granted forty of the sixty companies that registered access to the group. Of the forty accepted, eleven are blockchain-based and distributed ledger platforms.

In a public statement, the FCA announced that they would be testing propositions related to cryptocurrencies. The test will help officials to determine the consumer benefits and risk of such platforms in a controlled environment. The project already attracted some heavy hitters. Most notably, the platform 20|30 has partnerships with the London Stock Exchange and the financial service company Nivaura.

A New Age for Crypto

There is a shift in the crypto space as more and more regulatory approved platforms enter the market. These platforms trade the anonymity of previous cryptocurrency apps for a more robust and interoperable crypto experience. While trading your privacy for more accessibility isn’t ideal for all parties, it is a perfect fit for individuals looking to stay within the realm of traditional financial services.

Wirex managed to position their firm perfectly for the digitization of the economy. The ease of use their platform provides allows new crypto users to access the market with confidence. You can expect to see more all-inclusive blockchain-based platforms emerge in the crypto market as this year progresses.

The post Wirex Receives E-Money License appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube