On its 6th birthday, Coinbase received high praise from Shapeshift’s Erik Voorhees. He Tweeted, “Coinbase remains the most successful and important company in the crypto industry.” Arguably, that is very much the case. The San Francisco-based cryptocurrency exchange with its barebone menu of offerings, combined with its easy user-interface and relatively smooth onboarding (almost no upfront deposit needed), provide an envious business model. That’s not to write the company is without faults, as it has many. It might not even be the future of retail crypto access, and perhaps it shouldn’t.

Also read: Zimbabwe Bans All Cryptocurrency Activity, Businesses Have 2 Month Grace Period

Coinbase is Easy, Light, Feisty

“Today is Coinbase’s sixth anniversary,” wrote COO Asiff Hirji. “We’re celebrating six incredible years working toward our mission to help create a more open financial system for the world! […] We are in the early days of our mission and there is still so much to do […] Have to know when to follow the rules, when to bend them and when to push to change them. Breaking them is neither ethical nor sustainable.”

It’s probably less of an exchange proper and more of a conservative cryptocurrency bank. It might be fair to simply label it a broker (without bids, asks, limit orders, margin trading, etc). Coinbase, founded six years ago this week, is arguably the most important company, regardless of its technical classification, within the space. It alone is responsible for introducing millions and millions of Americans to the wild phenomenon that is decentralized currency speculation.

Offering bitcoin core (BTC), bitcoin cash (BCH), ether (ETH), and litecoin (LTC), its sparse choices work to underwhelm those new to speculating on cryptocurrency. The format is light and only requires a linked bank account. Without the bother of having to hold and maintain decentralized currency, users can simply use the Coinbase client and trade for fractions, sometimes as low as $2.00. Fees, of course, apply.

At the time of available statistics, the Northern California broker had something like 13 million users (Altana Digital Currency Fund), some days back in 2017 clocking them at 100,000 new sign ups every twenty four hours. For a little while there, Coinbase was a top ten downloaded application in the Apple Store. Its yearly revenue eclipsed venerable legacy houses such as Charles Schwab.

Embarrassment of Riches

It continues to nab top professional financial sector talent such as Asiff Hirji from TD Ameritrade; to that end, it poached Facebook Messenger’s David Marcus to join its Board, and the two are exploring ways to exploit the social media platform’s giant user base in terms of blockchain technology (probably a proprietary token is in the works, but that’s a guess). Heck, even its alumni go on to do big things: Charlie Lee of Litecoin fame was a former director of engineering.

Merchants Dell and Expedia use it as a point of sale processor. For trading professionals, its Coinbase Exchange was rebranded to Global Digital Asset Exchange (GDAX), becoming one of the earliest to offer ether to financial pros.

For better or worse, Coinbase is the most prominent version of mainstreaming the crypto revolution. It’s young (CEO, Brian Armstrong, is barely in his mid 30s), feisty, ambitious, cocky, and sporting for market share. Its flounders are largely an embarrassment of riches: demand so great the company’s system crashed a few times during the runups of 2017, and its customer inquiries languished at times in ten day backlogs. Mr. Armstrong fired back, “There’s so many people rushing into the space, if it’s a bit of speculation, I’m O.K. with that. But we can’t guarantee the website’s going to be up exactly when you need it. Everyone needs to take a deep breath.”

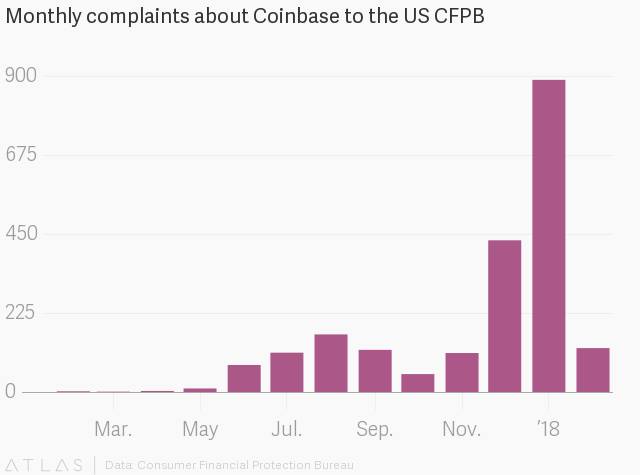

That particular hiccup hasn’t been put away altogether just yet, as in January of this year alone formal complaints to the Consumer Financial Protection Bureau rocketed by more than 100%. Almost half were filed regarding “money not available when promised,” which is no small matter.

Peril’s of Centralization

In the scaling debate, Mr. Armstrong came firmly down on the side of big blockers, and, according to various sources, holds most of his crypto wealth in ether. Under his leadership, the company embraced economic reality, choosing when to fight on principle and where to give-in. For example, it was one of the notable in its class to snag a controversial Bitlicense from New York. Howls of sell out and capitulation could be heard far and wide. But this move signaled to potential investors and the broader financial community the company was less strident and more pragmatic in the all-important ‘business sense.’

It would regain some of its punkier credibility, at least for a time, when the United States’ taxman came calling. The Internal Revenue Service (IRS) evidently can read eye-popping price headlines. As market leaders such as BTC rose exponentially, so did United States citizens’ tax obligations. Yet nearly no one was complying. History will show the company did fight back, but history will also show it lost, having to hand over customer information for those who moved more than $20K in crypto (small percentage of its users).

Then again, when New York’s top cop poked and prodded at exchanges, asking they account for this and that, Coinbase jumped as high as asked, issuing a very detailed letter. Kraken, on the other hand, went sideways at the presumption and hubris of such an invasion. The contrast could not be starker, and the more principled in the community noticed … as it did when it shut off access for Wikileaks, a seemingly purposeful separation from crypto’s anarchic roots. Such are the perils of centralization in the sense there are doors to kickdown, masters to please other than market demand.

For the more cypherpunk among us, it is critical to acknowledge the truth. Coinbase is good people, but Coinbase is also in bed with the same folks who prompted crypto’s birth. That won’t do, and won’t do by a lot. If censorship resistance and decentralization are fundamental pillars, then we should look for exchanges in those images. Leave traditional banking schemes itching to please governments to their future: slow death.

Is Coinbase an overall positive or negative in the crypto community? Tell us in the comments below!

Images courtesy of Shutterstock, Coinbase, Twitter.

Need to calculate your bitcoin holdings? Check our tools section.

This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

The post Coinbase Remains the Most Successful and Important Company in the Crypto Industry appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube