Getting started with bitcoin mining can be a difficult process for many. For example, you must consider things like the specific algorithm used by the Proof-of-Work cryptocurrency you want to mine. Additionally, bitcoin mining hardware can cost thousands or even tens of thousands of dollars. With all of these challenges it might be a good idea to look at alternative ways to gain cryptocurrency profits, but is cloud mining a legit, more profitable option in the long-run? In this article, we’ll compare these two possible options so you can make a more informed decision.

Costs of Bitcoin Mining Hardware

As discussed in this post, bitcoin mining hardware generally requires a substantial upfront financial commitment on the part of miners. First, it’s important to consider how much mining rigs cost. This not only depends on the cryptocurrency which you are aiming to mine but also how expansive and powerful your mining operation needs to be.

First, let’s consider hardware costs. If you want to mine BTC, for example, you’ll most likely need an ASIC mining rig. These are typically much more expensive compared to GPU and CPU mining rigs. Despite their potential to mine at much faster hash rates, ASIC mining rigs often face scrutiny for the fact that they cannot be repurposed. This means that, if a cryptocurrency project makes changes to their hash algorithms, ASIC miners will have to buy new gear. This can lead to some significant costs that can easily negate revenues and even lead to net investment losses.

In contrast, GPU and CPU mining gear can generally be repurposed if algorithm changes occur. In addition, these rigs are usually much less than their ASIC counterparts. Additionally, more projects are continuing to trend towards ASIC-resistance rather than ASIC-acceptance. For most miners, this means an overall reduction in both upfront and ongoing costs.

While having one mining rig might be a good first step to see if you can indeed become profitable, many people start out with more rigs to have a multiplier effect. However, even with rising prices, starting with multiple rigs should be done cautiously as each additional rig will likely add to the number of months it takes to make back your initial investment.

Of course, other factors like electric bill costs have to be considered. These vary by geographic area, making it difficult to put a precise amount on how much money is needed for keeping hardware rigs operations.

Costs of IT Cloud Mining

In comparison to hardware mining, costs for IT cloud mining are much simpler to calculate. Most companies run on a monthly subscription model that is determined by the cryptocurrency you want to mine and the hash rate speeds as seen on popular sites like Genesis Mining and HashFlare.

Prices for 2-year contracts of ETH mining with Genesis Mining currently vary from $1,520 at 40 MH/s to $12,960 at 360 MH/s.

HashFlare offers 1-year contracts of ETH mining for $1.80 per 100 KH/s.

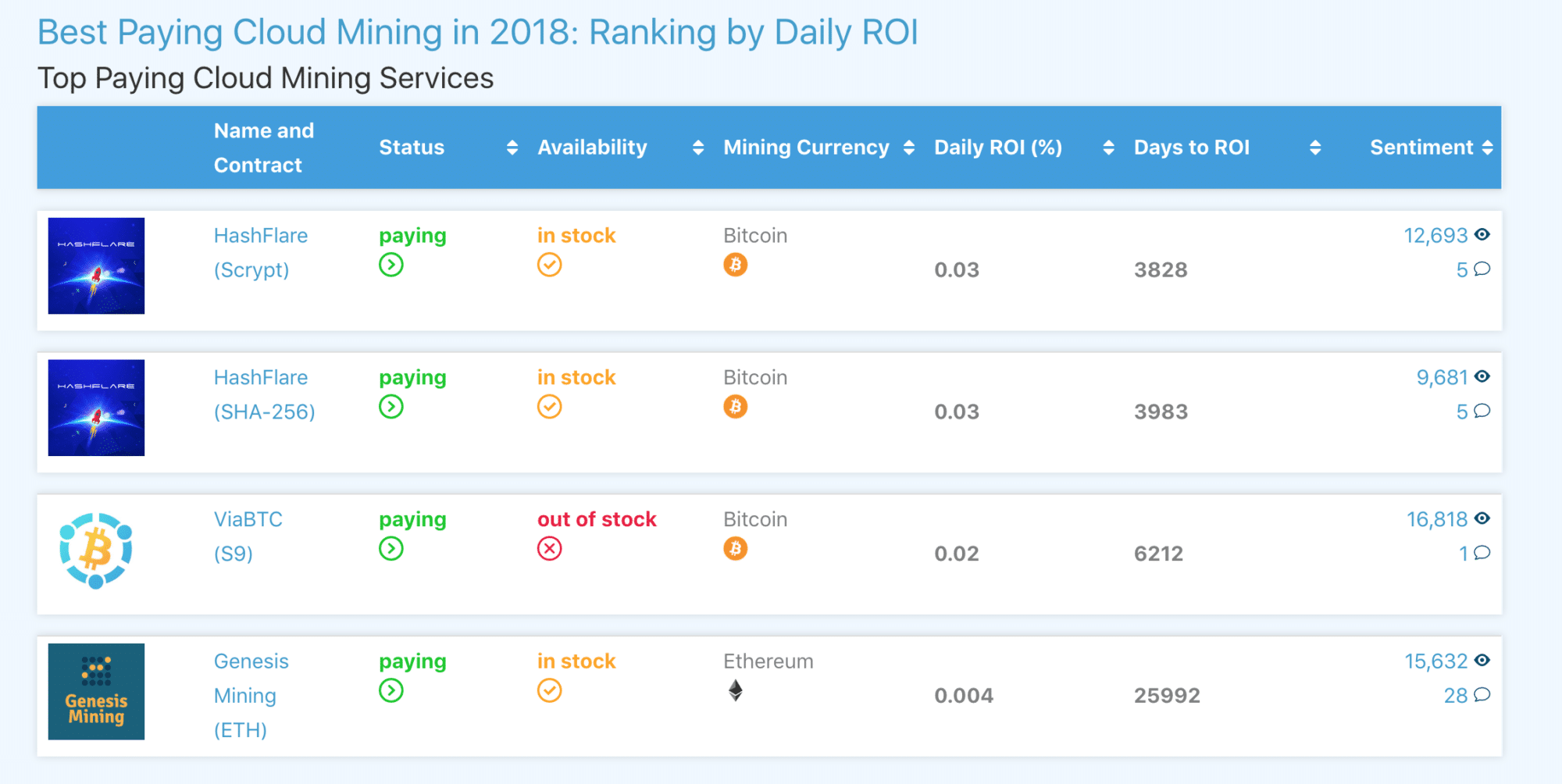

Make sure to read reviews and check out projected ROI on any cloud mining service. The fact is that there are many services with extremely low profitability and even some which are known scams. Luckily, there are a few guides available on the best ways to identify potential cloud mining scams.

Hardware Mining ROI

Even though there is no way to say for certain how long it will take to break even on investments in hardware mining equipment or cloud mining, it’s still crucial to do research on estimated time frames. According to most miners, it’s difficult to expect to become profitable within 3 to 6 months. 10-15 months is realistic for many, though. A lot depends on crypto prices, electric costs, and the type of mining rig you use. Nicehash provides a good calculator for determining this.

IT Cloud Mining ROI

Based on information from Reddit forums, reviews, and ROI calculators, it is clear to see that cloud mining isn’t all that popular or profitable. For example, as of May 30, 2018, HashFlare Scrypt and SHA-256 currently take 3,828 and 3,983 days (or a little over 10 years) to reach ROI on BTC respectively according to this calculator from Coinstaker. Genesis Mining for ETH has an even worse ROI, taking around 25,992 days (70+ years). In both cases, it’s difficult to justify cloud mining over hardware mining.

The problem with keeping a subscription for cloud mining is that it can be difficult to keep paying monthly even in bear markets. These stats could certainly improve if we see a massive bull run as seen in December 2017; however, it can be pretty difficult to predict when a bull market will begin and end.

Compare this to using bitcoin mining hardware, and the choice is a bit more obvious. That’s because, even if the market is bear, most costs are upfront and not recurring. Sure, there are costs like electric bills to consider with hardware mining, but there are several locations throughout the world where energy consumption is very cheap and hardware mining is legal, making it a clearly more profitable option than cloud mining even in bear markets.

Conclusion

Despite the high upfront costs, the consensus is that bitcoin mining hardware remains much more profitable than cloud mining. Possibly the biggest benefit of cloud mining is its overall ease-of-use since it requires no difficult hardware installation and avoids potentially unpredictable electric costs. However, most in the cryptocurrency community would agree that if you can’t start a hardware mining operation, it’s probably best to make profits through trading rather than going the cloud mining route.

The post Is Cloud Mining More Profitable than Bitcoin Mining Hardware? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube