One year ago to the day, Bitcoin Cash (BCH) came into existence after a hard fork from the Bitcoin blockchain.

It has been an interesting 12 months since the fork gave birth to BCH, as proponents have continuously argued the merits between Bitcoin (BTC) and BCH. Nevertheless, on the anniversary of the creation of Bitcoin Cash, it is worth revisiting what caused this altcoin to come into existence and what it aimed to do.

How did we get here

Since its inception in 2009, Bitcoin’s user base has steadily grown over the better part of a decade. In the past three years, this has caused some ‘growing pains,’ as the original parameters that govern the blockchain led to issues with transaction speeds and costs.

In the Bitcoin white paper, its creator — Satoshi Nakamoto — set out the technical details for a ‘peer-to-peer electronic cash system’ that would enable people to transact without the need for a central authority.

While you can read Cointelegraph’s guide on Bitcoin here, the preeminent cryptocurrency is run by a network of computers which validate and share an ongoing ledger of transactions that requires hash-based proof-of-work algorithms to prevent double spending.

These transactions are validated and then stored in blocks by miners. Each block is limited to holding 1 MB worth of data before they are added to the blockchain. When a miner unlocks a block, a certain amount of Bitcoin is brought into existence.

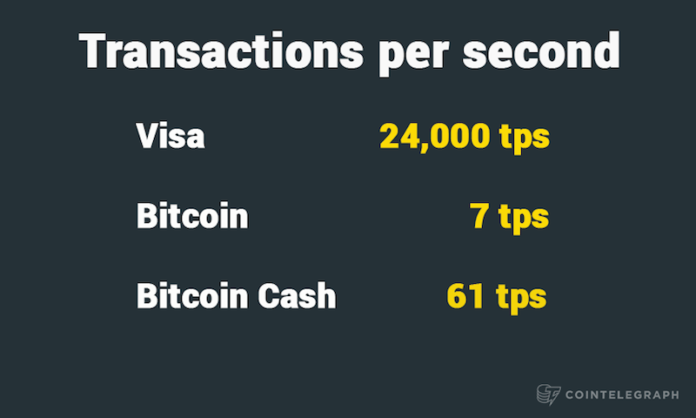

Here is where scaling has recently become a problem. As more people started using Bitcoin, there was a spike in the amount of transactions. The network became congested due to the volume that needed to be validated, which caused transaction fees to rise. Simply put, it was becoming slower and more expensive to use Bitcoin for transactions.

As the graph below illustrates, fees gradually increased into 2017 onwards:

This eventually led to the wider Bitcoin community — comprised of big mining pools, wallet and exchange service providers and developers — to discuss ways to address these problems.

This gave birth to what is known as Segregated Witness (SegWit), a soft fork in the Bitcoin protocol that originally looked to solve transaction malleability. However, it was then proposed that SegWit should include an update in block size from 1 MB to 2 MB, and here is where the community came to a crossroads.

SegWit was eventually implemented — bar the size increase — but some members of the community pushed for a hard fork that would implement the size change as well.

Bitcoin Cash was born courtesy of a fork on August 1, 2017. The Bitcoin community then celebrated the launch of SegWit on August 24.

Controversy

The launch of Bitcoin Cash was a highly contentious issue among the cryptocurrency community for a number of reasons.

As mentioned above, some members of the community were dead set on SegWit including a block size increase to provide more capacity for transactions on each block.

When it became clear that SegWit would go ahead without this change, a group of miners planned the hard fork, which would see a number of changes to the protocol — including an increase from 1 MB per block to 8 MB.

BTC.com vice president of business operations, Alejandro de la Torre told Cointelegraph about the importance of the forking:

“The ability to make forks while keeping the community aligned was a great achievement. By providing much greater bandwidth per block by first increasing to 8 MB and then again to 32 MB. This additional room is more than what is needed right now, but BCH seems to be looking ahead and getting ready to process high volumes of traffic. The greater block size also enables BCH to store more information in each transaction, giving the blockchain space to write smart contracts on-chain at low costs.”

As a fork of the Bitcoin blockchain, users that held Bitcoin would receive an equal number of Bitcoin Cash at the time of the fork.

Chinese mining manufacturer Bitmain was an original proponent that suggested the Bitcoin Cash hard fork in 2017, but later clarified the move as a contingency plan to a soft fork. Amaury Séchet is credited with the first announcement of Bitcoin Cash, originally known as Bitcoin ABC.

Bitcoin vs. Bitcoin Cash

Since then, Roger Ver has arguably been the biggest promoter of Bitcoin Cash. His initial backing of BCH in 2017 was met with skepticism, partly due to his involvement in an earlier fork, Bitcoin Unlimited (BU).

Ver strongly supported BU and, at one point, even claimed he would sell his BTC holdings in favor of the forked coin. However, once Bitcoin Cash was launched, the owner of Bitcoin.com seemed to jump on the bandwagon.

Since then, Ver has seemingly pushed an anti-BTC agenda, beginning with claims that Bitcoin Cash is the ‘real Bitcoin’ in November 2017.

As for the ideological battle between BTC and BCH, De La Torre suggests that the fervor between the different camps highlights the faith that different people have in the two cryptocurrencies:

“Both cryptocurrencies have clear benefits that attract users according to different interests and use cases. We don’t see them as mutually exclusive, but more as complimentary coins. BCH was created to immediately preserve Bitcoin’s status as an electronic cash system and its focus has stayed on that goal.”

The Bitcoin.com website has also faced pressure from the cryptocurrency community, with a group going as far as pushing to launch a lawsuit against the website for using misleading language and information.

Image source: Bitcoin.com

The Twitter handle @Bitcoin was temporarily suspended in April by the social media platform after numerous complaints about BCH-promoting tweets — flaring up the argument between BTC and BCH proponents.

Furthermore, Ver has constantly promoted BCH on his personal Twitter account. This has been met with some disdain by other industry leaders.

Shapeshift CEO Erik Voorhees went so far as telling Ver publically on Twitter in April to refrain from tying him to his opinion that BCH is Bitcoin.

Roger – please stop referencing me to back up your opinion that Bitcoin Cash is Bitcoin. It isn’t. Bitcoin is the chain originating from the genesis block with the highest accumulated proof of work. The Bitcoin Cash fork failed to gain majority, thus it is not Bitcoin.

— Erik Voorhees (@ErikVoorhees) April 27, 2018

Galaxy Digital owner Michael Novogratz also took a shot at the @Bitcoin Twitter account for its BCH promoting tweets in May.

Enough already. Bitcoin core is BTC. It is a store of value. It is digital gold. It’s market cap dwarfs bitcoin cash. If you want to be a payments currency by definition you need to have stable value. So why own it. ??

— Michael Novogratz (@novogratz) May 5, 2018

Bitcoin Cash — by the numbers

While the BTC vs. BCH debate that has been raging on with no end in sight, Bitcoin Cash has established itself as one of the strongest cryptocurrencies in terms of market value.

The competition of BTC and BCH, De La Torre believes, is a vital part of the ongoing development of the cryptocurrency ecosystem.

“Ultimately utilizing cryptocurrencies as a digital currency is what will push the entire industry forward. #HODL has been a rallying call for many within the cryptocurrency community, but I hope that the rallying call to #BUIDL (build blockchain solutions and decentralized businesses) will galvanize sustainable and practical uses of Bitcoin and BCH alike, building a new age of peer-to-peer financial sovereignty open and accessible to all.”

According to data from Coinmarketcap, BCH is currently ranked number four by market capitalization, with over $13 billion. However, BTC still holds a massive 47 percent of the total crypto market cap.

BTC.com was one of the earliest wallets to provide BCH support, which has given the platform some unique insights into the altcoin’s development. In its short year of its existence, De La Torre highlighted its adoption by different services and exchanges:

“One of the metrics we find most interesting is applications: BCH has expanded onto 19 different services — e.g., Bitpay, Coingate, Viabtc, Coinpayments and Coindance. Bitcoin Cash is also involved in 14 different projects — e.g., OpenBazaar, Joystream and Counterparty — and is tradable on 41 different exchanges.”

Despite BCH’s controversial birth in 2017, Bitcoin still holds a massive dominance on the overall cryptocurrency market. However, as De La Torre points out, each and every cryptocurrency that has gained widespread use aims to provide a unique service that is challenging the financial world as we know it.

The two will continue to be used by people around the world for differing reasons, but the history that led to the emergence of Bitcoin Cash will always make for interesting reading.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube