The popular cloud mining service HashFlare announced earlier this year that it had suspended services to its Bitcoin contract customers. In a July statement via Facebook the company noted the ongoing issues with SHA-256 contracts:

“For over a month our users encountered a situation when the payouts were lower than the maintenance fees, resulting in zero accruals to the balance. As of 18.07.2018, the payouts were lower than maintenance for 28 consecutive days.”

SHA-256 is the mining algorithm used to validate transactions on the Bitcoin network, and HashFlare provides hardware solutions to cater for this. Naturally, many of these customers were upset by this suspension as growing suspicions of yet another crypto scam were forming. Cloud mining, in general, does not have a good reputation and plenty of scams have surfaced with the rise in popularity of cryptocurrency.

What Is Cloud Mining?

Operating crypto mining rigs requires a decent amount of research and expertise. Add to that the often hefty downpayment on hardware and you may ask, “Why not simply outsource it?” Well, that’s the idea behind services like HashFlare and Genesis, two popular cloud mining platforms.

By purchasing the mining power of rigs located elsewhere you don’t have to deal with the expertise, set up, and maintenance needed to run the right hardware. Cloud mining still remains a popular choice for newcomers. With little effort and a credit card, you can purchase a share in a large-scale mining operation.

That’s the marketing speak anyway. As savvy readers will no doubt be aware, there are no easy ways to make money in crypto. And many of these easy services ultimately turn out to be scams.

Who Is HashFlare?

HashFlare was started in 2015 and is a department of a company called HashCoins, which produces cloud mining software and hardware. Although the company is registered in the UK, most of the team appear to come from eastern Europe (Estonia).

Previous reviewers have reported that a team page was available but unfortunately HashFlare has apparently since removed it from their website. This was the first red flag in our HashFlare review. In the wake of so many online scams, solid crypto companies should be providing verifiable links to their teams, products, and services.

The HashFlare Shutdown Debacle

The decision to suddenly cut service for customers of the Bitcoin SHA-256 contract was reportedly due to the instability of the Bitcoin market. This statement confused many customers since cryptocurrency markets have remained volatile since 2009, when Bitcoin hit the markets.

Proper service resumed a week later and the team provided a well-rounded response here. We, however, came across this calculator on their website still showing decent profits on HashFlare payouts:

Theoretical profits via HashFlare

At the time of press release, Bitcoin had dropped around 40 percent since the suspension of service in July. You see the dilemma here. If mining was unprofitable back then, there must surely be concerns now as markets continue to sell off.

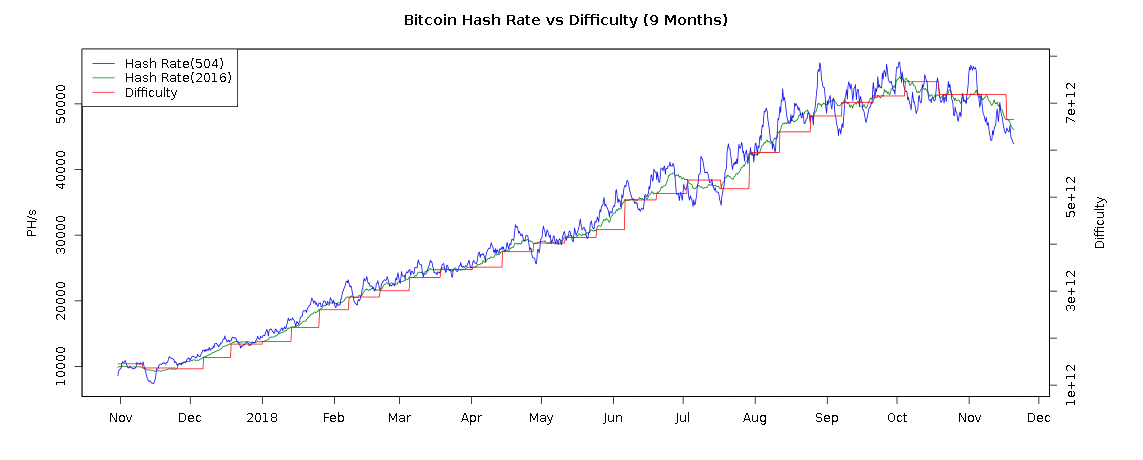

To further back up this point it would be useful to take a look at some Bitcoin statistics for 2018. Unless you’ve been living under a rock for the past year you’ll no doubt be aware of the current bear market. While prices have been steadily dropping, the Bitcoin difficulty has been doing quite the opposite:

Bitcoin difficulty continues to climb despite 2018 bear market

Miners are feeling the pain. And if you were thinking about becoming one yourself, you may want to ask yourself first if it’s not easier simply just to buy the underlying coin in the first place.

The final straw of the debacle came when out of the blue HashFlare demanded that customers start verifying identity via KYC/AML. This angered many customers because they were not required to verify their identities when signing up for the service. This tactic is often used by shady exchanges who gladly accept new customers up front without verification and then try to block users who want to withdraw funds.

Nobody on the Fence

Despite largely negative press around the service shutdown, there appear to be supporters on both sides of the fence. Judging from comments, a fair number of reviewers have been happy with their service, while others sit in the opposite camp. This is a rather polarizing view of the situation.

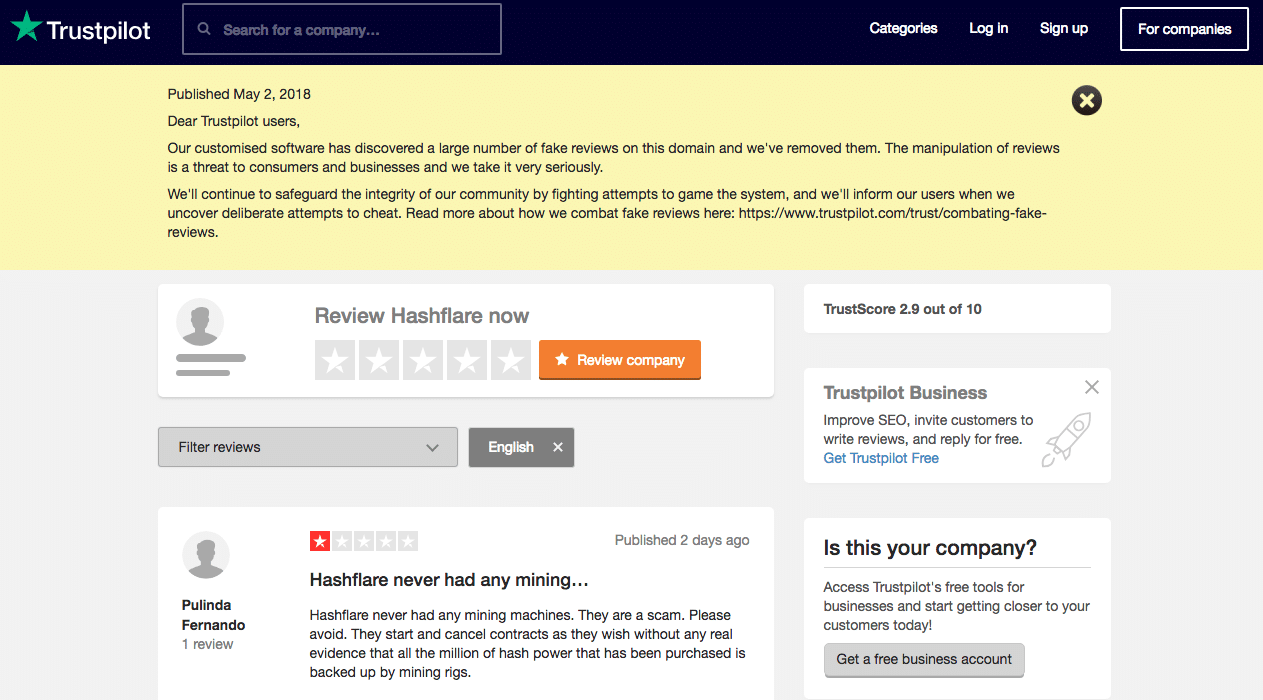

We had a look on Trustpilot (the business review site) and came across this additional red flag regarding the potential manipulation of reviews.

HashFlare may have been posting fake reviews to build up a solid reputation

HashFlare Review: Final Thoughts

Despite the warning signs, some cloud mining users still report profits from going the easy mining route. From our observation and review of general community sentiment, quite the opposite appears to be the case. There’s no absolute way to tell if HashFlare is a legitimate operation. Or any other cloud mining service for that matter.

And therein lies the problem. The probability of actually meeting someone accountable for a cloud mining service is rather slim. Furthermore, how can you verify that your rented hardware is actually being used? This scenario creates the perfect conditions for a Ponzi scheme. Unsuspecting clients pay a lot of money for a service upfront and their profits are returned in small amounts by new users joining the scheme.

In all likelihood, the people that got in first will build up the reputation of the service for a while. If they’re not too greedy, they may even have a chance to get their money out first. Other won’t be so lucky. When scammers head for the exits, the profits will be going with them.

Cloud mining remains a high-risk activity. You have to place most of your trust in a third party. It may be boring, but from many viewpoints, buying and HODLing still appears to be a much safer solution.

The post HashFlare Review | Cloud Mining Takes Another Reputation Hit appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube