When Gareth Nelson and Charlie Shrem founded BitInstant in 2011, they hoped this exchange would become one of the top companies in cryptocurrency. However, regulators shut down the exchange in 2013. Even though BitInstant did receive a good bit of funding and experienced rapid growth, its demise was swift. Let’s look at what led to the fall of BitInstant and try to think about what we can learn from this event.

BitInstant Early History and Funding

When we think of cryptocurrency exchanges in 2018, there are numerous options available on the market. Back in 2011, however, this was certainly not the case. The reality was that the market had very few options for crypto traders back then. Mt. Gox, one of the first-ever crypto exchanges, had only launched in 2010. Still, it didn’t take too long for BitInstant to become a major player in the industry.

By May 2013, BitInstant already employed 16 people, and the company was beginning to experience major user growth. Then, Winklevoss Capital invested $1.5 million into the company. According to the Winklevosses, the funding was “meant to allow the company to further scale up its staff and product.” BitInstant later announced a partnership with the Winklevosses’ bitcoin investment fund.

User Growth and Major Partnerships

At one point, BitInstant experienced an average growth rate of 1.5x per month and facilitated transactions worth one million dollars each day. Possibly, one of the biggest catalysts for this growth trajectory was the rising prices of cryptocurrencies in 2012 and 2013. In December 2012, BTC was at around $13. By April 11, 2013, the price per BTC had skyrocketed to $266. Users could buy crypto on the BitInstant exchange with fiat currencies. Options included USD, RUB, and BRL. Trading fees started at 0.26%. The exchange dynamically calculated rates based on various factors.

In June 2013, the exchange announced integration with Jumio, an online payment company that allowed BitInstant to verify customers’ identity. BitInstant even allowed its customers to purchase cryptocurrencies through more than 700,000 stores. Physical stores included Walmart, CVS, Walgreens, Duane Reade, 7-11, and Moneygram locations.

The BitInstant exchange team also made a few other strategic partnerships that increased user growth. For instance, the company partnered with a service called Coinapult. This partnership allowed users to convert cryptos and claim funds via SMS or email. In addition, BitInstant partnered with the BitcoinSpinnermobile app, which added greater accessibility for purchasing crypto.

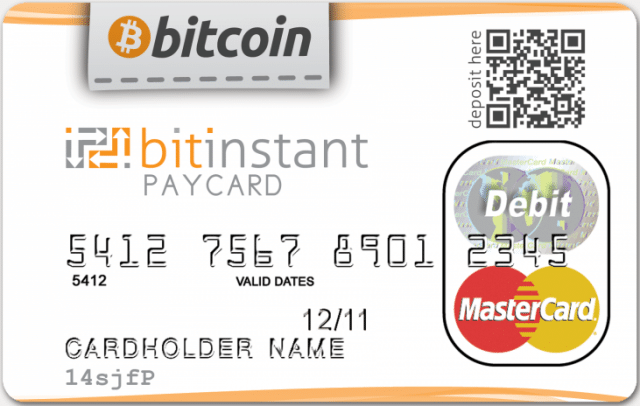

BitInstant even had its own Paycard, which was similar to a prepaid debit card. Image: Ars Technica

The Fall of BitInstant

As you can likely tell, BitInstant was on a path to long-term success in its early stages. Nevertheless, a few signs started to signal the exchange’s issues. Shortly after the Jumio integration, BitInstant had to shut down trading operations in a few states due to regulatory pressures.

In July 2013, BitInstant suspended its services in order to “improve the code based on trends they noticed.” Soon afterward, the company received around 17,300 customer service complaints. A few weeks later, customers filed a class action lawsuit that charged BitInstant with a failure to perform services and false representation.

Finally, on January 27, 2014, a joint task force of FBI, IRS, DEA, and other law enforcement officials arrested CEO Charlie Shrem at JFK airport for “conspiring to commit money laundering by selling more than $1 million in bitcoins to users of the black market website Silk Road.”

After the BitInstant website shut down, users who visited the URL simply found a blank screen.

Charlie Shrem led the BitInstant team until the exchange shut down operations. Image: Steemit

Shrem Goes to Jail

Shrem, who also served as the person in charge of AML compliance at BitInstant, was accused of knowingly facilitating transactions to a Silk Road re-seller, Robert Faiella. Another major issue with this case was that Shrem deposited more money than recently-passed money transmitter laws allowed for. Transactions with Faiella were done off the books in an effort to get around legal requirements.

In September 2014, Shrem pled guilty in connection with indirectly sending an estimated $1 million in BTC that was used on the Silk Road.

In December 2014, he was convicted of aiding and abetting the operation of an unlicensed money transmitting business. The court also ordered Shrem to forfeit $950,000 and sentenced him to two years in prison.

In March 2015, Shrem entered Lewisburg Federal Prison Camp in Pennsylvania. Officials released him from prison in mid-2016.

More Fallout?

In September 2018, the Winklevoss twins filed a lawsuit against Shrem for $32 million. The twins claimed that Shrem stole thousands of BTC from them back in 2012. As a result of this case, officials have frozen some of Shrem’s assets. Documents also show that, as of November 2018, Shrem has yet to pay the $950,000 restitution fee required for his 2014 conviction.

The Winklevoss twins are suing Shrem for $32 million. Image: Twitter

What Can We Learn from This?

There are three main takeaways from the case of the BitInstant exchange’s rise and fall.

First, this case demonstrates all of the things that can go wrong when a company doesn’t comply with legal and financial regulations. Prior to these issues, the exchange was one of the more successful ventures in cryptocurrency. Who knows? It could have become one of the top exchanges that we know today if its team had followed money transmitter laws.

Second, Shrem’s story proves that it is possible to learn from past mistakes and try to move forward in life. Shrem admitted that he let the success of BitInstant get to his head. Even though the exchange failed and Shrem served jail time, he has still maintained his status as a popular influencer in the blockchain/crypto space. In fact, Shrem now works as a consultant/advisor on several major projects.

Finally, this story demonstrates just how quickly the landscape of crypto exchanges has evolved in just a few years. BitInstant once processed nearly 30% of all bitcoin transactions. In 2013, the company appeared to be invincible with its quick user growth, strong partnerships, and sizeable venture funding. The momentum that the company had gained seemed to point towards BitInstant becoming a successful crypto behemoth in the making.

Furthermore, virtually none of the top exchanges by trading volume in 2018/2019 even existed yet. That leads us to the question, “Will the exchanges that crypto traders use today be the go-to options a few years from now?” This is yet to be determined, but something to be aware of when examining the trends in this ever-changing industry.

The post BitInstant Exchange: Lessons Learned from the Shut Down appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube