Cryptocurrency markets have been bullish lately as most of the top digital asset prices have seen decent gains over the last week. The overall market capitalization of all the coins in existence is roughly $132 billion this Sunday and global trade volume has increased significantly considering it’s the weekend before the holidays with $20 billion traded over the last 24 hours.

Also read: Everything You Need to Know to Start Trading Cryptocurrencies

Cryptocurrency Bulls Still Have the Reigns

On Sunday, Dec. 23 the day before Christmas Eve, there’s been more digital asset swaps than usual compared to a few holiday trading sessions in the past. Global digital currency trade volume for many of the top cryptocurrencies has increased significantly since the big drops in price two weeks ago. The top ten digital asset markets are also up in value between 2 to 15 percent over the last 24 hours increasing the general market valuation of the entire crypto-economy. Bitcoin core is up 2.6% for the day and 21.7% over the last seven days. This gives BTC a global average of about $3,991 per coin and a market capitalization of around $69.6 billion. The cryptocurrency BTC currently has $6.2 billion worth of the entire ecosystem’s $20 billion worth of 24 hour global trade volumes.

The second highest valued market today is ripple (XRP) which is trading for $0.37 per coin and has a $14.9 billion market valuation. There’s been more than $648 million worth of XRP swapped over the last day and markets are up 3.3% this Sunday. The third highest valued market today commanded by ethereum (ETH) is up 14.5% over the last 24 hours and 47% for the week. One ETH is swapping for $128 across global exchanges and has a market valuation of around $13.3 billion. Lastly, the fifth position belongs to eos (EOS) this weekend as each coin is trading for $2.79 and markets are up today 9%. EOS markets have jumped 43% over the last seven days.

Bitcoin Cash (BCH) Market Action

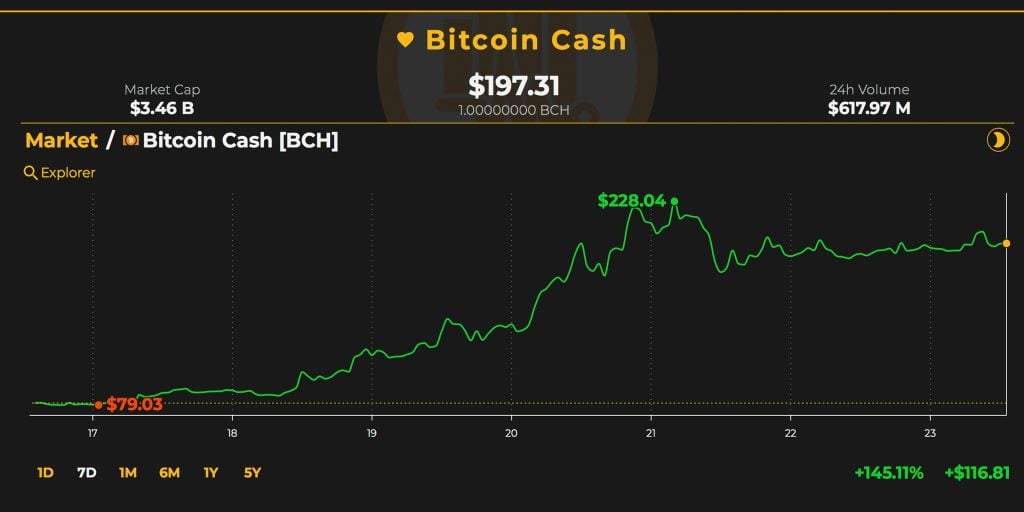

The phenomenal gains that bitcoin cash (BCH) had seen a few days ago have tapered a bit but BCH gained a whopping total of 140% for the week. Today BCH is up 4.6% and each coin is trading for $197. The top five BCH trading platforms swapping the most BCH this Sunday includes Lbank, Binance, Huobi, Coinbase, and Bitbank. Bitcoin cash trade volume is fairly high today capturing $610 million in trades over the last day. BCH is the sixth most traded cryptocurrency this weekend below ripple and above litecoin markets. The top currency pairs trading with BCH include USDT (42%), BTC (21%), ETH (19%), USD (8.7%), and the JPY (4.2%). The Korean won (KRW 1.9%), and the euro (EUR 1.5%) pairs against BCH are trailing not too far behind.

BCH/USD Technical Indicators

Looking at the BCH/USD 4-hour charts on Bitstamp shows bulls have the reigns and are seemingly still going strong. At the moment there is a lot of resistance between the current vantage point and price higher than $225. The two Simple Moving Averages (SMA) still have a decent gap between them but the 200 SMA looks as though it may drop below the short term 100 SMA trendline. This would indicate that the path towards least resistance would change to the upside but for now, it remains toward the downside.

The Relative Strength Index (RSI) shows conditions are nearing overbought regions at 65.84 on the 4-hour chart. BCH bulls have shown their prowess on the 3-day chart and the percentage gains were far more than most digital assets in this time frame. The Moving Average Convergence/Divergence (MACd) has been dipping downward at the time of publication and shows room for improvement over the next 24 hours. As mentioned above, order books also show bulls need to surpass the $225 range to get some better momentum. On the backside, bears will see some light resistance back to $177 but after that, there are fewer foundations.

2017’s All-Time Highs Are Still Far Away

Cryptocurrency market sentiment this weekend is far better than the last few weeks of brutal dumps and price fake outs. Although 80-90% corrections are not out of the ordinary when it comes to digital asset volatility and market declines in the past. There is still a strong amount of skepticism and pessimistic traders who feel the past few days may not be indicative of a market bottom. On the other hand, BTC/USD and ETH/USD short positions on Bitfinex have dropped considerably this week indicating that traders may not be so confident the price will drop again. Overall cryptocurrency infrastructure continues to grow stronger and well known financial institutions are clearly making moves on the sidelines. Still, it will take a large factor to drive cryptocurrencies higher in value and surpass the all-time highs of 2017.

Where do you see the price of BCH, BTC and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Coinlib.io, Bitstamp, the Coinbase Dashboard, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Bitcoin Cash Gains More Than 140% This Week appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube