Proof of Burn (PoB) is a relatively unheard of consensus method that aims to address the energy consumption problems found in proof of work (PoW) systems. Iain Stewart, the creator of proof of burn, argues that both proof of work and proof of stake consume real resources, which could be otherwise used for better purposes. Bitcoin is obviously the most notable PoW network. Though, the jury is still out on what the environmental impact of it really is.

How Does Proof of Burn Work?

When coins are destroyed on the blockchain we refer to them as being burned. This is the conventional way to explain the concept, although nothing is technically destroyed. The actual implementation requires sending coins in circulation to an unspendable address, known as an eater address.

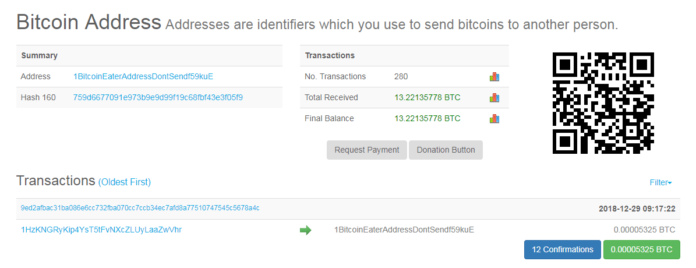

Eater addresses have no private key, which means that while anybody can view the total coins and transactions at that address nobody can access it to unlock the funds. It’s important to provide this kind of transparency so that the public can verify whether coins have actually been burned. There are a number of ways to implement proof of burn that we’ll cover in the next section. Here is an example of an eater address:

Proof of Burn Cryptocurrencies

Counterparty

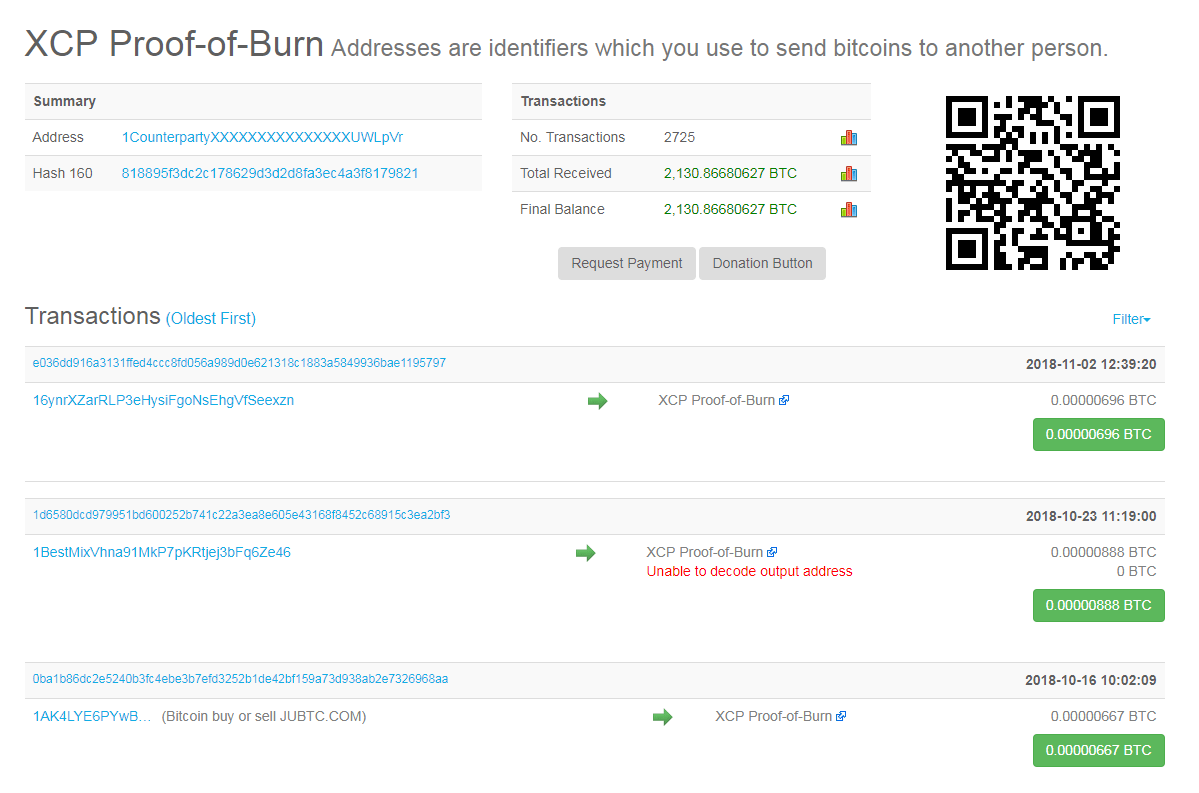

The most notable example of a PoB cryptocurrency is Counterparty. It has a relatively long history in such a young industry, as it was launched in 2014 before Ethereum and the ICO craze. Counterparty tokens (XCP) are created on the Bitcoin blockchain when BTC is sent to an unspendable Counterparty address:

Counterparty eater address holding around 2,100 Bitcoins!

Slimcoin

Slimcoin uses a different model. Miners need to burn a part of their coins in order to secure the right to mine new blocks on the network. In theory, this means that miners are still working to secure the network, except that it’s in the form of the destruction of coins. The idea here is that miners don’t need the heavy expense of hardware and electricity to do the work.

Factom

Factom uses a more complicated implementation process called burn and mint. In the Factom ecosystem, tokens are constantly being created through the project’s monetary policy. On the flip side, tokens are burned as data is committed to the blockchain. Essentially, the more the Factom network grows the more tokens are burned, and ultimately the coin supply should decrease.

Pros and Cons

In the case of Counterparty, the obvious advantage of this approach is that miners are encouraged to stick around for the long-term. Cryptocurrency is a fascinating industry, but the frequency of new coins, forks, and, hash wars calls into question stability of many of these networks. When everyone is out to make a quick buck there’s little chance of creating projects that will benefit users for years to come.

In terms of negatives, we once again have to draw our attention to the problem of centralization. Those who have more resources to burn can do so and are in turn rewarded with more mining power. This doesn’t deal with the mining centralization problem we currently see with Bitcoin.

It’s unclear yet whether this will adequately deal with the rich get richer problem that exists in many economic systems. In addition, some implementations of proof of burn remove coins from the Bitcoin supply forever. If those networks fail then the dedicated Bitcoin can never be recovered.

Burn as a Feature

Though not implemented completely in their consensus methods, there are other cryptos that use burning as a feature for a number of other benefits.

Transaction Fees

Networks also burn coins to pay for transaction fees. Several networks currently use this tactic including the likes of Ripple, Binance, and Request Network. Binance encourages users to hold their BNB tokens as a way to reduce transaction fees on their cryptocurrency exchange.

They also burn tokens on a quarterly basis with the aim of achieving a total supply of 100 million coins. BNB initially circulated with twice that number. Needless to say, the fact that they have a working utility token and a descending money supply has made the demand for their token pretty robust. BNB is one of the few tokens that has outperformed Bitcoin since listing.

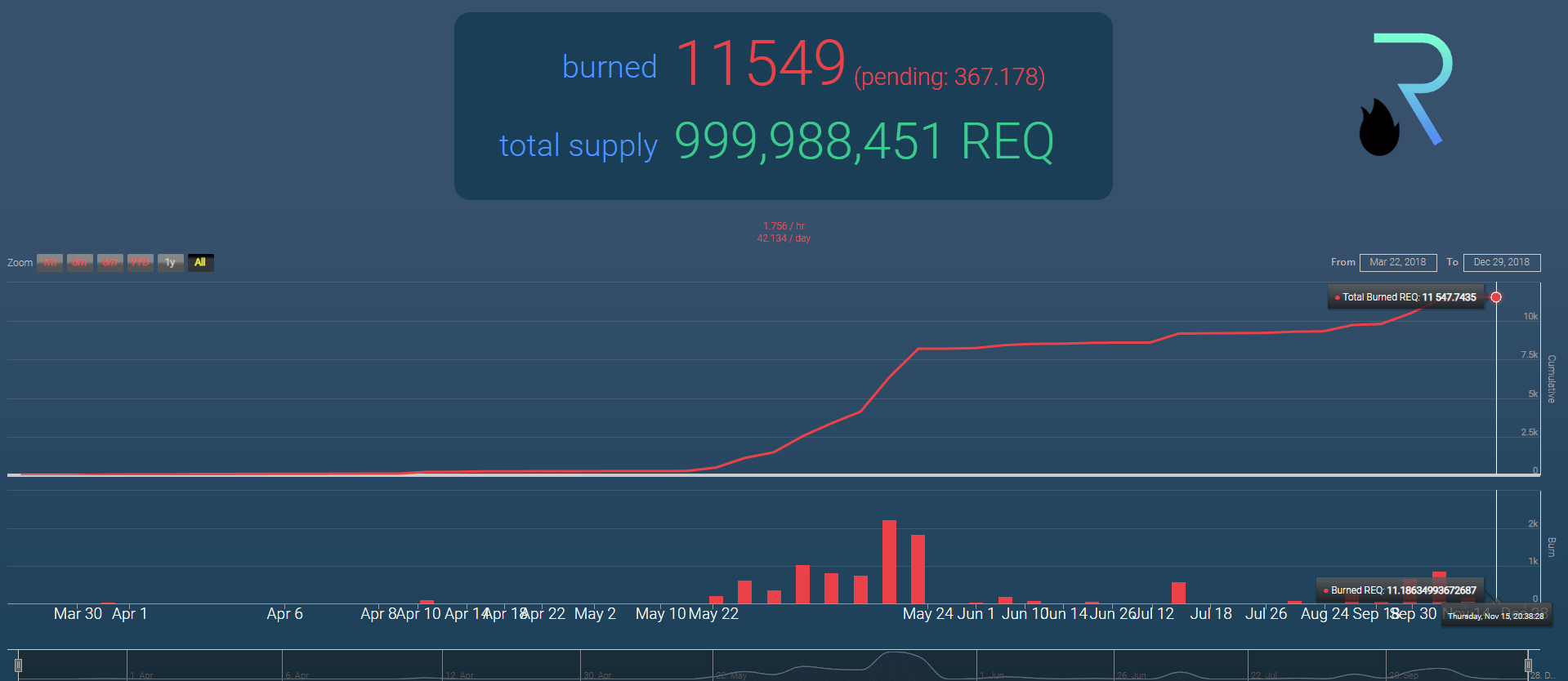

In the case of Ripple and Request Network, the process is different. Each time a user makes a transfer they pay transaction fees, and the network burns a small amount from that fee. Again, this has the effect of reducing the total supply of that coin. Compare this with Bitcoin, where the miners take the fees. In this scenario, the value is spread to everyone in the network from the resulting deflation.

Request Network burn history

Unsold ICO Coins

Many new cryptocurrency projects have a predetermined supply. Some projects decide as part of a commitment to their investors that any unsold coins should be burned. This is a small but worthy effort to return value to the backers of their idea.

Feel the Burn

Proof of burn is a novel consensus method that outlines the interesting ways in which the cryptocurrency space is evolving. It essentially allows new coins to bootstrap off of existing established networks, like Bitcoin, to gain the benefits that they’ve already achieved. Unfortunately, the uptake has been pretty low across the board.

As we saw from the Counterparty example above, around 2,100 Bitcoins have been taken out of circulation to create XCP tokens. This does not appear to be a very sustainable model long-term. The theory that this will ensure commitment from network participants is a pretty large gamble. This doesn’t really take into account building a meaningful network and then getting people to adopt it. No amount of Bitcoin can guarantee success.

It also has the negative effect of removing Bitcoin from the total supply. This will probably drive up the price of Bitcoin, which may be good for investors in the short-term. The end goal, however, is for people to use something like Bitcoin as a medium of exchange and not just a store of value. There’s still time of course for proof of burn to prove itself, but so far it seems that using coin burn as a feature may be more beneficial than just as a means to consensus.

The post Proof of Burn | Consensus Through Coin Destruction appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube