Cryptocurrency prices have been seemingly stable lately as there hasn’t been much volatility in the last two weeks in either direction. The overall market capitalization of the entire crypto economy has lost about $4 billion since our last markets update and global trade volumes are much slimmer than weeks prior.

Also read: Properties Are Still Being Sold for Cryptocurrency Despite the Bear Market

Traders Are Patiently Waiting for the Next Big Move

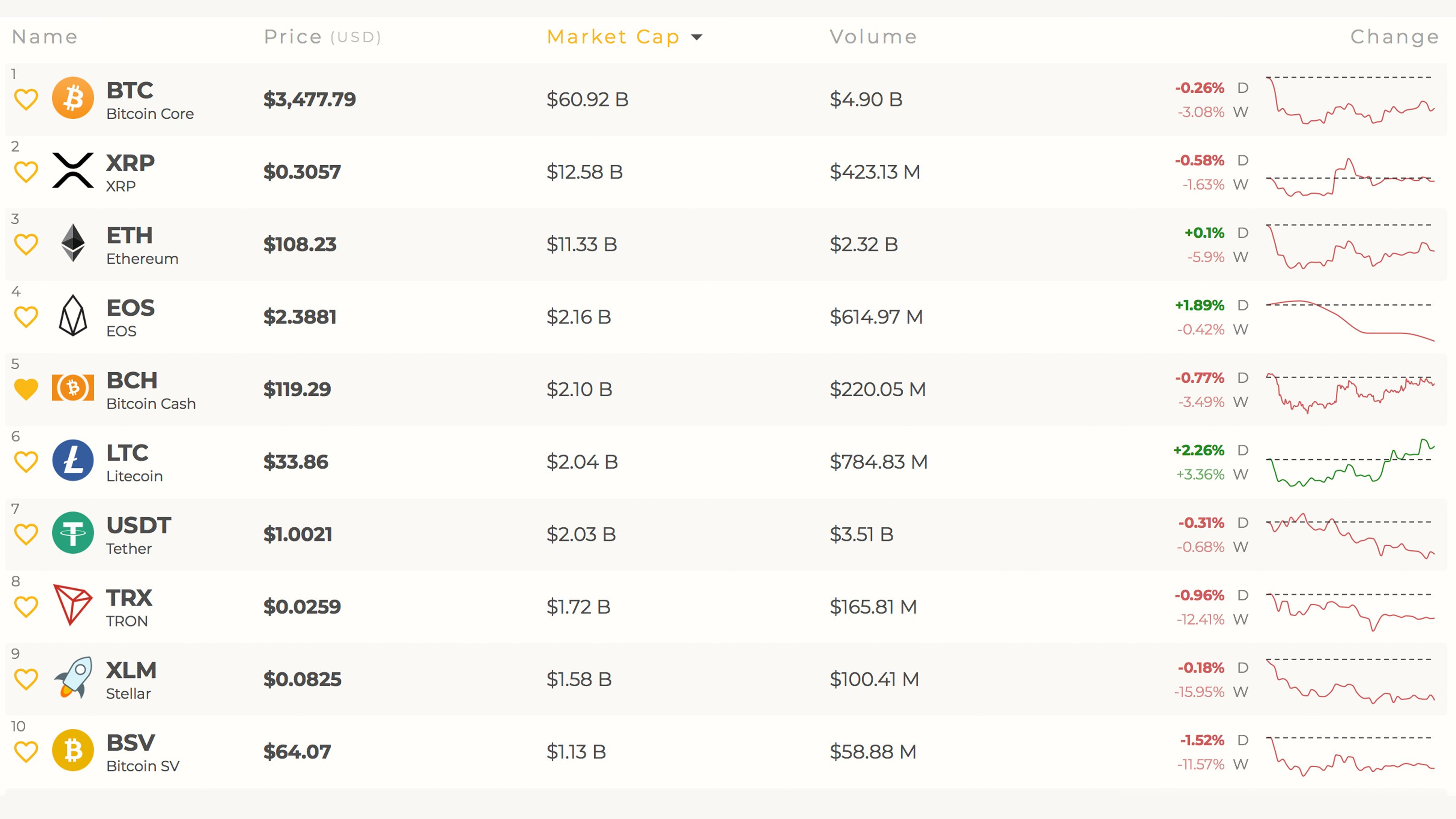

Traders are itching and waiting for the next big move in crypto land as the entire digital asset economy of all 2000+ coins has been relatively stable. There have been a few price spikes here and there by a few lesser known coins, but most of the top digital currencies haven’t moved very much. This Sunday, Feb. 3, the price of bitcoin core (BTC) is hovering around $3,477 and has a market valuation of about $60 billion. BTC is down a hair today percentage-wise and down more than 3% for the week.

The second largest market capitalization is captured by ripple (XRP) and each coin is swapping for $0.30. Not too far behind ripple is ethereum (ETH) which holds the third highest market valuation at $11.3 billion. ETH is trading for $108 per coin and the market is down over 5.9% in the last seven days. In the fourth position is eos (EOS) which is priced at $2.38 per token at press time and is up 1.89% today leading the top 10 pack.

Bitcoin Cash (BCH) Market Action

Moving on to bitcoin cash (BCH), traders will see that the coin is trading for $119 per BCH this Sunday. The decentralized cryptocurrency has an overall market valuation of around $2.1 billion but has lost more than 3.4% this week. The top five BCH trading platforms swapping the most BCH this weekend include Lbank, Fcoin, Binance, Hitbtc, and Huobi.

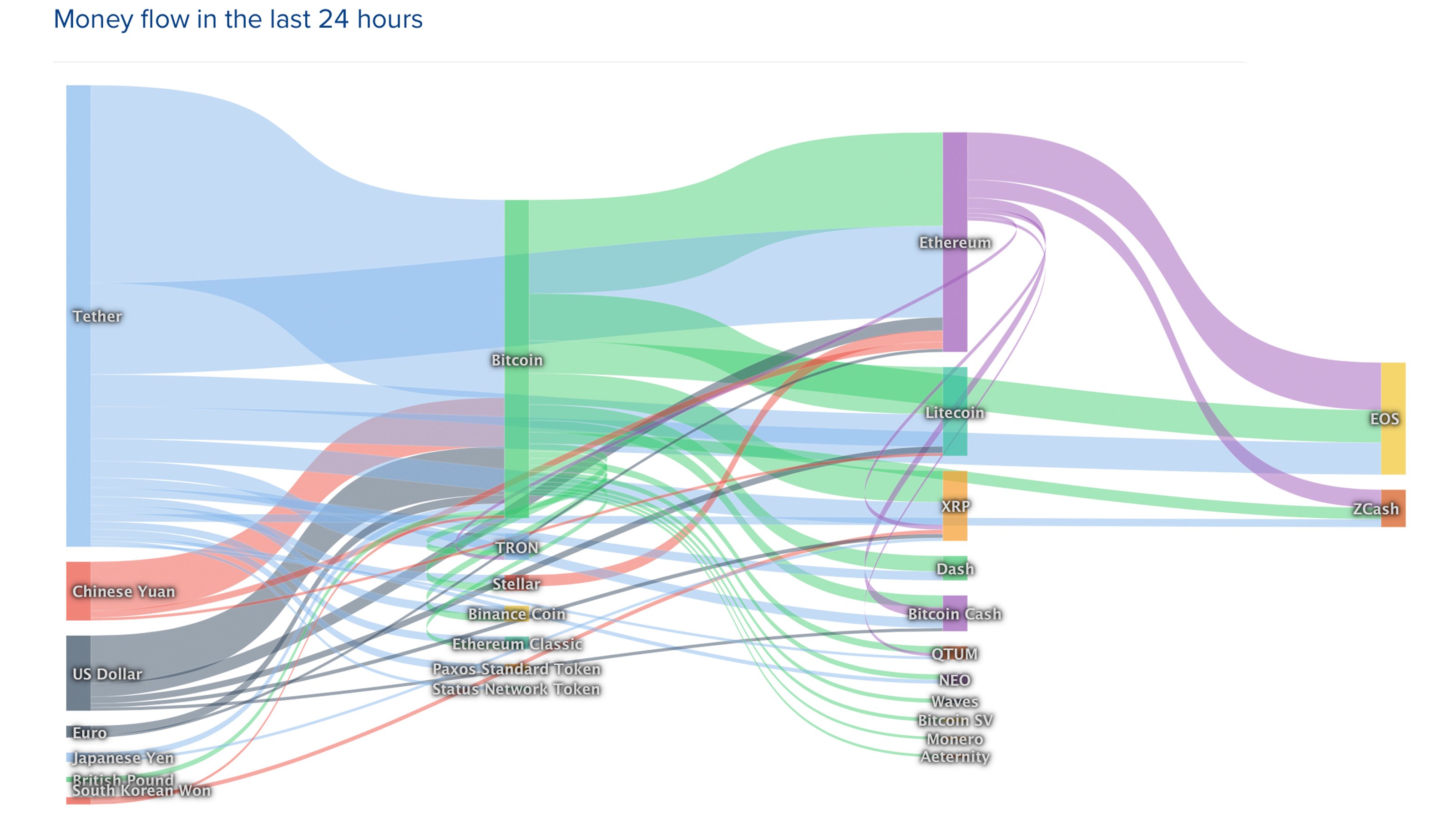

USDT (tether) is dominating the BCH trades today by 39% and ETH is not too far behind at 33.5%. Following behind those pairs are BTC (14.8%), USD (5.4%), KRW (4.9%), and JPY (0.90%). This weekend, bitcoin cash is the seventh most traded cryptocurrency as far as global trade volume below XRP and above CKUSD.

BCH/USD Technical Indicators

Looking at the 4-hour BCH/USD chart on Bitstamp shows the price has been consolidating but still has been dropping slightly, hence the 2% loss over the last seven days. Currently, the two Simple Moving Averages (100-200 SMA) are still spread apart but looks as though they may cross hairs in the near future. For now, the long term 200 SMA is well above the short term 100 SMA, which indicates the path toward the least resistance is still in favor of the bears. RSI and Stochastic oscillators show oversold conditions are still dominating the playing field and MACd seems as though it will be heading southbound in the short term.

There’s been six months of downward prices and dead kitties bouncing so bulls need to press past the 200-week moving average (MA) in order to gain some better headway this time around. Order books show there’s some pretty good resistance up until $130 a coin and things look smoother from there. On the back side, after a week of consolidation, foundations are slimmer than the week prior and bears will see pit stops between now and $110 for the second time in two weeks.

The Verdict: The Growing Sentiment of Uncertainty Dominates the Entire Global Economy and Is Not Secluded to Crypto Markets

Overall, traders are still waiting patiently for the next big move and other global markets may be playing a role. The global economy has been stuttering and many leaders and economists worldwide believe society is on the brink of another economic crisis like 2008. Safe haven assets like gold have experienced a significant increase since the economic tides began shifting and this sentiment may have kept cryptocurrencies from dropping further.

Moreover, the U.S. Federal Reserve has been heavily discussing pausing interest rates which could affect the western economy a great deal. Since cryptocurrencies like BTC and BCH have seen price declines, the global SHA-256 hashrate has declined since last October by more than 35%. However, there’s been a slow and steady increase in hash power this year and around 10% of that power has been recovered. This indicates miners who have a lot of skin in the game are more confident and cryptocurrency price values could follow suit. For now, traders must wait but still many hope the longest bear run in crypto history will soon see a reversal.

Where do you see the price of BCH, BTC and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Bitstamp, Coinlib.io, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.

The post Markets Update: Traders Patiently Wait for Crypto’s Longest Bear Run to End appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube