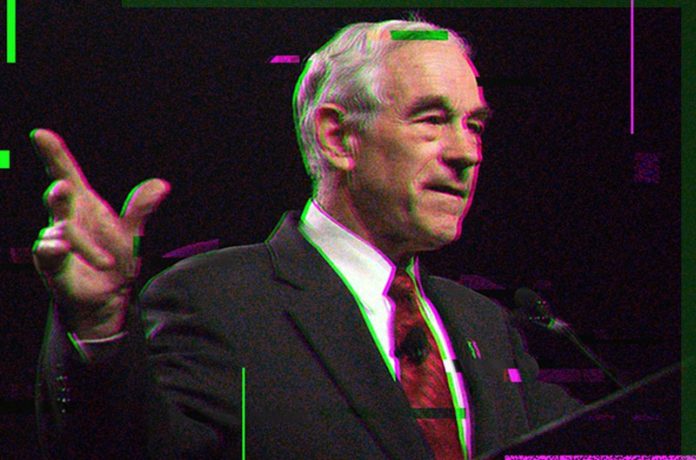

Dr. Ron Paul was into sound money before it was cool.

Before he became an initiate in the Austrian school of economics, he served as a flight surgeon in the United States Airforce and as a private practice OBGYN in Texas. Proselytized by the works of Ludwig von Mises and Ayn Rand, Paul decided to run for Congress in the ’70s following the termination of the Bretton Woods agreement — an international pact that was the dollars final, albeit tentative, tie to the gold standard.

Nixon’s decision to withdraw from this agreement would have lasting consequences on U.S. monetary policy and Dr. Paul launched his political career as a crusade against these changes and the danger he saw in the fiat economy that they created. In his on-again-off-again career as a politician — which included Texas Congressional Representative terms from 1976 to 1977, 1979 to 1985 and 1997 to 2013 as well as presidential runs in 2008 and 2012 — the godfather of the modern right-wing Libertarian movement made a name for himself with his zealous advocacy of the gold standard and his uncompromising critique of the Federal Reserve and the hazards of its monetary policy.

As a fledgling congressman, his position on the House Banking Committee gave him a platform to disseminate his Austrian ideals. Today, his 2009 bestseller End the Fed and his 2012 presidential run can be seen as career capstones which also encapsulated the core tenets of his political philosophy: liberty, revolution and sound money.

It’s not shocking, then, that Ron Paul is privy to Bitcoin. He and his son, former presidential candidate and Kentucky Senator Rand Paul, accept bitcoin for their political foundation.

Dr. Paul attended this year’s Consensus conference as a guest of the Digital Asset Policy Network (DAPNet), a cryptocurrency policy and lobbying firm led by veteran campaign manager Jesse Benton and Bitcoin Center Founder Nick Spanos. During the conference, Bitcoin Magazine sat down with Dr. Paul to discuss his views on bitcoin as a disruptive and sovereign asset. Our conversation showed that gold bugs have more in kind with bitcoiners than not (and it’s also a good reminder that bitcoin is not age specific — not every old bull is a salty no-coiner à la Warren Buffet).

When did you first learn about bitcoin and what were your initial reservations with it?

There was no one time where I read an article and it struck me. I just heard a little about it, but I didn’t pay too much attention to it. And then I finally got interested enough to watch what it was doing in the marketplace — I love to watch markets — and, you know, down to $0 up to $20,000, that was sort of fascinating. What does this mean? I’m still trying to figure out what the endpoint is.

So that got me interested, and then I looked at the technology and I’m not a computer person. If I had to explain blockchain technology, I wouldn’t do well. I’m interested in the issue of alternative currencies, I’m interested in what happens when the market crashes and I’m interested in preserving an environment where people can have alternative ideas that might help solve the problems we have. I think that’s what bitcoin offers: an alternative. I want a free marketplace.

I’ve heard you mention free markets in relation to bitcoin, in an interview with CoinDesk, for instance. I want to ask you about Congressman Sherman’s remarks on a ban of cryptocurrencies. What do you think this signals for Congress? Do you think we’re going to see hostility?

There will be hostility but it will be more dignified. They will work behind the scenes and put in roadblocks if they can. The more successful that cryptos are, the more the government will get involved. There are people like Sherman, but they won’t be talking like that. I don’t think that he has the clout since he’s over the top. They’re not [going to] all of a sudden pass this; I don’t even think he’ll introduce a bill. It won’t be a movement, it just got everyone’s attention.

Do you think Congress is paying more attention to these things than it’s letting on? Because we’ve seen some incompetency from Congress when it comes to technical topics.

No, I don’t think there are many [people in Congress] who are more knowledgeable than I am and [they’re] much less interested in the principles of the marketplace. And they’re less in agreement that big problems lie ahead, so they have less interest in Bitcoin. I don’t think that if you did a poll for Congress about whether to ban it or tax it, they probably haven’t thought it through. Republicans I would think would tend more to be very tolerant, but lovers of big government like Brad Sherman — they know what is going on. His reaction, his emotions are his belief, because he can see what could happen to the Federal Reserve’s monopoly over the monetary system. You can’t allow people to talk about using alternative currencies. Usually, we punish people for that.

To your point toward the end there, it seems like Sherman has thought it through. Because if you listen to his argument, he basically says cryptocurrency poses a threat to the dollar’s dominance and the U.S.’s international commerce.

That tells you a lot. He’s speaking for the deep state establishment, military people and everyone else in the banking system. He’s representing their position that “You don’t mess with the dollar.” But I don’t worry about that because the dollar is going to self-destruct.

Yeah, I want to touch on that. In End the Fed, you speak of the dollar like a ticking time bomb just waiting to go off. What do you think could accelerate it and do you see crypto acting as a sort of hedge as we’ve seen with gold and silver at times of market volatility?

I would think so, but someone else needs to answer that question. I just want to make sure that there’s allowed to be a hedge. In our country, for a lot of years, we weren’t allowed to own gold as a hedge. I think that there are a lot of time bombs. We have difficulty figuring out what our foreign policy is. You know, the on-again-off-again with Syria and North Korea, Iran.

The John Boltons and Abrahams of the world and the senators that are wild — as long as they are in charge, a bad accident can happen or a bad judgement made. That could change everything. That could change the dollar system; it could change the stock market.

In End the Fed, you talk about a financial crisis that is worse than in 2008 to 2009. Do you think that we’re starting to see the foundations shake? Is the writing on the wall?

I think so, but it’s been there a long time. I decided that this trend was established with our announcement that we no longer could honor the dollar. Which was really an announcement of bankruptcy, and it’s been steadily building up the problem. And the trust in the dollar has allowed the bubble to get bigger. It’s held together for a long time and that’s just going to make the crash worse.

I’m glad you mentioned the word “bubble” because that gets thrown around a lot in this industry. What would you say about the volatility of bitcoin when taken in kind with the devaluation of the dollar through inflation?

There’s going to be volatility. The dollar is going to be volatile. You have the supply and demand of the dollar: how many people really want to use it versus how fast they’re printing the money. A lot of people look at prices in terms of supply and demand but they don’t look at the purchasing power of the dollar, which is hard to calculate. The thing that I realized in 1971 was that, since Nixon took us off the gold standard, this is a different world. Now, we have the digital currencies and I think they’ll follow the same economic laws, but there is going to be a subjective element to it. You can’t deny that there was some subjectivity when bitcoin hit $20,000. But does that mean it’s worthless? No, I don’t think so — things do that. This is new, so it’s going to have ups and downs.

If we see a threat to it, when someone comes along and says, “We need a law to ban cryptocurrencies to get rid of this uncertainty.” That to me is going to be around and it’s going to be a lot worse.

Do you think that the best way to regulate this is to not regulate it at all? Or do you think that there’s a way to let these bitcoin and blockchain companies grow organically while providing investor protections?

I believe in regulation and that it has to be strict, but who are the regulators? Ever since the Depression, we’ve had hundreds of thousands of rules and regulations regulating the financial system and yet we still had 2009. It didn’t do any good. And then when they decided that they need to save the system, they went hog wild rewarding the people who had already been ripping us off: the mortgage companies. And the people who lost their mortgages didn’t get rescued.

I want to return to gold really quickly. Have you seen Grayscale’s Drop Gold campaign? It is trying to make gold obsolete and replace it with bitcoin, which it says is a digital alternative.

Well, they’re missing the whole point. If it’s obsolete, the market will declare it obsolete. But in a crisis, even if people are using bitcoin in a crisis, gold is going to be used. I’d think that you’d be a very wealthy person if you had a bag of gold coins in Venezuela.

Bitcoin has gone on an insane uptrend recently while the DOW, S&P and other traditional markets are trending downward. Do you think that it’s a little bit early to say this shows a decoupling from traditional markets?

Yes, I think it’s too early to tell. I don’t think anybody knows. It’s hard to say, but there’s obviously enough confidence in bitcoin for people to go and buy it. But did you have one million buyers or 15 buyers? That could be pretty important.

Last question: Do you own any bitcoin?

Do I own any bitcoin? No. We accept bitcoin at our foundation, but we immediately convert it because we need to pay our bills.

This article originally appeared on Bitcoin Magazine.

Bitcoinmagazine.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube