The wide variety of crypto exchanges on the market today have always been overwhelming. Currently there are 263 exchanges listed on Coinmarketcap, and that’s not even counting the unlisted ones. It’s a highly competitive industry, where the top players can earn profit counted in hundreds of millions of dollars. Nevertheless, new players and new exchanges appear nearly every day. What can they offer seasoned traders? To answer this question, we have to understand what features a trader needs to be able to trade comfortably.

What are they looking for

Of course, every trader has his/her own list of necessary features, but they can be divided into three different categories:

- Security

- Variety of traded tokens

- Accessibility

When we talk about security, it means that we hope to find our funds tomorrow in the place we’ve left them yesterday. Exchange hacks and security leaks happen very often. In fact, even after many years of security development, hackers managed to steal $927 million from crypto exchanges in 2018, according to the report by CipherTrace. According to another report by Ledger, 2018 became the record year for the number of hacks; each day $2.7 million is stolen from exchanges. So security is one very important trait.

Another important trait is the variety of tokens listed on the exchange. Traders love having a choice; some of them trade small-cap tokens and soon it becomes very irritating to switch between exchanges to trade those rare tokens that are ready to pump. It’s better to have them in one place.

And the last one is the accessibility offered by the user interface. This one has a crucial role because it’s the first thing that’s visible while visiting the exchange. With so many competitors, every exchange must develop a very thoughtful approach to designing its interface.

There are also several additional traits left undiscussed. For example, some people need fiat deposits/withdrawals, some need the support for trading bots or liquidity for large orders, and the list can go on. But the main features that every trader needs are the three presented above. What exchanges can fulfill these demands?

Decentralized exchanges – it’s easier than it looks

In reality, a DEX can be the perfect solution for every trader. A DEX is very hard to hack because it’s as secure as the blockchain it runs on. Unlike centralized exchanges, all funds belong to the trader, staying on his/her account. To steal them, you’d have to find a way to bruteforce the private key, but so far such technologies don’t exist yet.

If a trader wants a large variety of tokens, a DEX is the perfect place to go. Because it’s decentralized, it’s easier for companies to list a token. In many instances, there’s no need for approval, hence there’s no central authority. While many centralized exchanges take a large fee for listing, up to $2.5 million, listing on many DEXs, for example, on IDAX, is completely free.

What’s stopping many traders from using a DEX is the myth that using it is a lot more complicated than trading on a centralized exchange. This myth comes from old outdated prototypes of DEXs that were really unfriendly. Nowadays, there’s a lot of new modern DEXs whose developers care about usability. Let’s talk about these!

Peer-to-peer trading with a friendly interface

What are the best exchanges we can name? Volentix, IDEX, and OpenLedger. All of them have their perks.

IDEX is the oldest exchange on this list. It’s specialized in trading Ethereum ERC20 tokens. It has 130 tokens listed and a pretty high daily volume for a DEX – more than 300 BTC. It can be used with MetaMask or a hardware wallet, such as LedgerNano. The only thing you need in order to trade there is the private key of your account. The exchange functionality is pretty basic; it matches two orders from a buyer and a seller, then the trade occurs on the blockchain. The rules for trading can be found here.

The same principle is used by OpenLedger. It’s a decentralized exchange, working on BitShares’ graphene protocol, which makes it very fast. In addition, it requires no registration. OpenLedger allows the trading of more than 50 cryptocurrencies, including BTC, ETH, NEO, and DASH. It has an intuitive interface, and if you are already familiar with crypto wallets, it would be quite clear how to trade on OpenLedger.

And the last one, easily the most advanced of the three, is Volentix. It’s more than a DEX, it’s a DAE (Digital Asset Ecosystem). That means that aside from an exchange it includes a multicurrency P2P wallet, a user-friendly tool for market analytics, and a community program. All the things that a trader usually needs to find by himself in one place.

So why is Volentix VDEX the best choice among all other decentralized exchanges? First of all, it’s built on EOS.IO, meaning that it works as fast as OpenLedger, and a lot faster than Ethereum-based IDEX. Secondly, it offers a unique ecosystem, coupled with everything a crypto trader might need. Vespucci, an analytics tool, features all market data and news about many assets to help users make better informed decisions. And a third advantage is the improved liquidity, as VDEX uses Bancor algorithms to bring stability to its digital assets.

A recent announcement on Yahoo finance by CEO of Stex maybe indicative of the potential of such a anticipated event

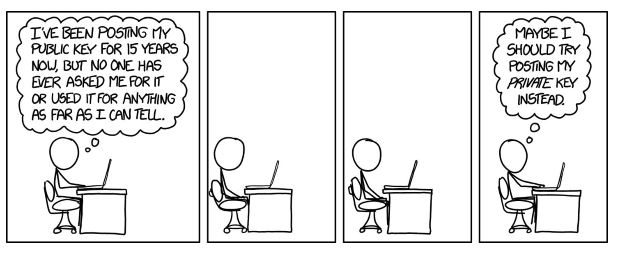

Source: xkcd.com

Of course, when trading on VDEX you still have to remember your private key. If someone gets access to your private key, you are exposed to the same risks you’d have while trading on any other exchange out there. The concept of a DEX is unfamiliar to many users, and it may require many years to pass until it gets really popular, but at least Volentix takes the extra step towards its users to make sure they have all the necessary tools and knowledge required.

The decentralized exchanges have evolved a lot since the early days of crypto. Now they offer the same features as the large centralized exchanges. They allow to trade easily without any prior setup, all you have to do is to create a wallet. They offer a user-friendly interface, identical to common trading terminals, but more importantly, they leave you in full control over your own funds. You don’t have to send them to an exchange’s wallet, an easy target for hackers of all kinds. The only thing you should care for is keeping your own private key safe. If you know how to handle the keys, there’s no reason not to try trading on a decentralized exchange, such as Volentix’s VDEX. Perhaps this new experience will change the way you look at trading.

TheBitcoinNews.com – Bitcoin News source since June 2011 –

Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections. TheBitcoinNews.com holds several Cryptocurrencies, and this information does NOT constitute investment advice or an offer to invest.

Everything on this website can be seen as Advertisment and most comes from Press Releases, TheBitcoinNews.com is is not responsible for any of the content of or from external sites and feeds. Sponsored posts are always flagged as this, guest posts, guest articles and PRs are most time but NOT always flagged as this. Expert opinions and Price predictions are not supported by us and comes up from 3th part websites.

Advertise with us : Advertise

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube