Bitcoin mining has not been profitable for small solo miners for a long time now. But how will the upcoming Bitcoin halving affect medium and large-sized operations as well as the rest of the crypto market?

Most of the crypto community believes this event will bring a boost in the BTC price and start an extremely bullish period for the rest of the cryptos.

But there are some serious doubts that the reduction in mining rewards will positively impact the market.

What Is the Bitcoin Halving

Bitcoin is programmed to halve every four years, a process that reduces the block generation reward by half. This mechanism was instituted in order to regulate the supply of Bitcoin and its production. When BTC reaches its total cap of 21 million, the network will stop producing new coins.

source: NewsBTC

source: NewsBTC

Currently, 85% of the total Bitcoin cap has been mined, which represents 18 million BTC. Even though it seems that there are few BTC to be mined, there is still a long way to go, as the Bitcoin halving slows down the creation of new coins. The halving is set to happen every 210,000 blocks, and this year, the event is estimated to happen in May.

After the halving will occur, miners will no longer receive 12.5 BTC for a block, with the reward being reduced to 6.25 BTC.

Effect on BTC Price

By looking at its previous halvings, Bitcoin usually experiences a surge in the price a while after the halving.

But another factor is the supply/demand ratio, which determines the evolution of the price. After a Bitcoin halving, the scarcity of the coin will increase. In order for BTC to see an increase in price, there has to be a demand on the market for the asset.

Bitcoin halving has greatly impacted miners and their activities and has prompted many to give up on mining as they could not make profits. The miners who continued to stay in business will probably sell their Bitcoins at a profitable rate, which can impact the asset’s asking price and drive its value up.

When the first halving occurred on the 28th of November, 2012, BTC was priced at $11 per unit. In the following 12 months, Bitcoin shot up to $1,100, which was unprecedented at that time. The price then corrected itself and crashed to $220. In the next couple of years, BTC hovered below the $1,000 mark.

source: CoinMarketCap

source: CoinMarketCap

The second Bitcoin halving took place in July 2016. At that time, BTC was fluctuating between the $600 and $700 marks, and then, the next year in 2017, it shot up to start the great bull run that brought the coin to $20,000. This meant an increase of 33 times compared to its price prior to the second halving and an increase of 1,818 times its price before the first halving.

The next halving, which will happen in just two months, has many from the crypto community hoping for a new bull run, which will take BTC to a new all-time high.

Some crypto experts, including Jesse Powell, the CEO of Kraken, are very optimistic, believing that Bitcoin will go beyond $100k after the halving, thinking it is likely that BTC even reaches $1 million.

Digital marketing officer, Jeffrey Barroga, from Paxful believes that: “It all boils down to the price of Bitcoin after the halving,” explaining that “If there’s no significant increase, Bitcoin mining may no longer be sustainable unless you’re a major mining centre.”

“Mining is already competitive and resource-extensive as it is, and when you combine that with the impending block reward reduction in May, hobbyist miners and small players might find that whatever BTC they gain is insufficient to pay for the overhead costs of running their rigs,”- he concludes.

Moreover, there are experts such as Jason Williams, the co-founder of Morgan Creek Digital, who believes the BTC price will see a low impact from the halving. Williams explained that the cryptocurrency community knows the date of the next halving and that miners usually prepare before a Bitcoin halving, and this is why he thinks the event will not have a major effect on the price of BTC.

“For the community that is living this day to day they know the event is there. They even know the date (within a few days). Large miners that are holding BTC will have to sell to cover operational expenses or use cash as revenue halves.”

New buyers have to come in to move this market up. So other than a new headline, the halving is being dealt with now by those who are operationally affected by it. Those that don’t will be priced out of the mining business.”- stated Williams.

Impact on the Mining Market

doctorbitcoin.com

doctorbitcoin.com

The reduced reward rate may push many miners out of the market, taking into account the high cost of mining hardware, energy, and bandwidth, which will continue to rise in price along with the difficulty of the network.

Currently, Bitcoin mining is done by large-scale operations. Five Chinese-based mining companies control just under 50 percent of all Bitcoin mining, which makes it seems like the market has reached a point of centralization. These large mining companies have the necessary resources to cope with a decrease in rewards and harsher margins on Bitcoin mining. Because of this, the Bitcoin halving may lead to greater market consolidation and place the Bitcoin network in fewer hands.

But it isn’t certain that the centralized mining market scenario will happen. If the halving drives the price of BTC higher, then mining could be profitable enough for smaller miners to continue their activities.

Bitcoin miners can spend up to $10,000 on high-end rigs, and experts estimate that the new GPU models will see a surge in 2020, as demand increases.

Coronavirus Impact on Bitcoin Halving

Because of the global coronavirus outbreak, a massive sell-off in all asset markets was triggered, with investors frantically selling low and high-risk assets alike. In the past weeks, Bitcoin, stocks, and gold have shared a similar price movement, reacting the same with correlation to this event.

Alejandro De La Torre, vice president of mining pool Poolin, claims that there is not enough evidence at the moment to prove that Bitcoin’s price has an inverse correlation with stocks or the general financial market.

“This is a test of the theory that Bitcoin is a hedge against market instability. We tend to see yearly events where this theory is tested. There is conflicting historical data on this theory (sometimes the price increase sometimes not), the results I believe are still inconclusive,” – said De La Torre.

BitGo co-founder, Ben Davenport, has also assessed that it is difficult to consider Bitcoin as a low risk or high-risk asset at this moment.

“Bitcoin is neither a risk-on nor a risk-off asset at this point. It still marches to the beat of its own drum. The actions of whales and leveraged traders are far more meaningful than any macro concerns.”

The COVID 19 outbreak does not affect the price of Bitcoin itself, but it directly impacts the supply chain of miners and mining producers. The transport and border restrictions imposed in order to minimize the pandemic has affected many manufacturers worldwide across various industries, as they are unable to ship their products.

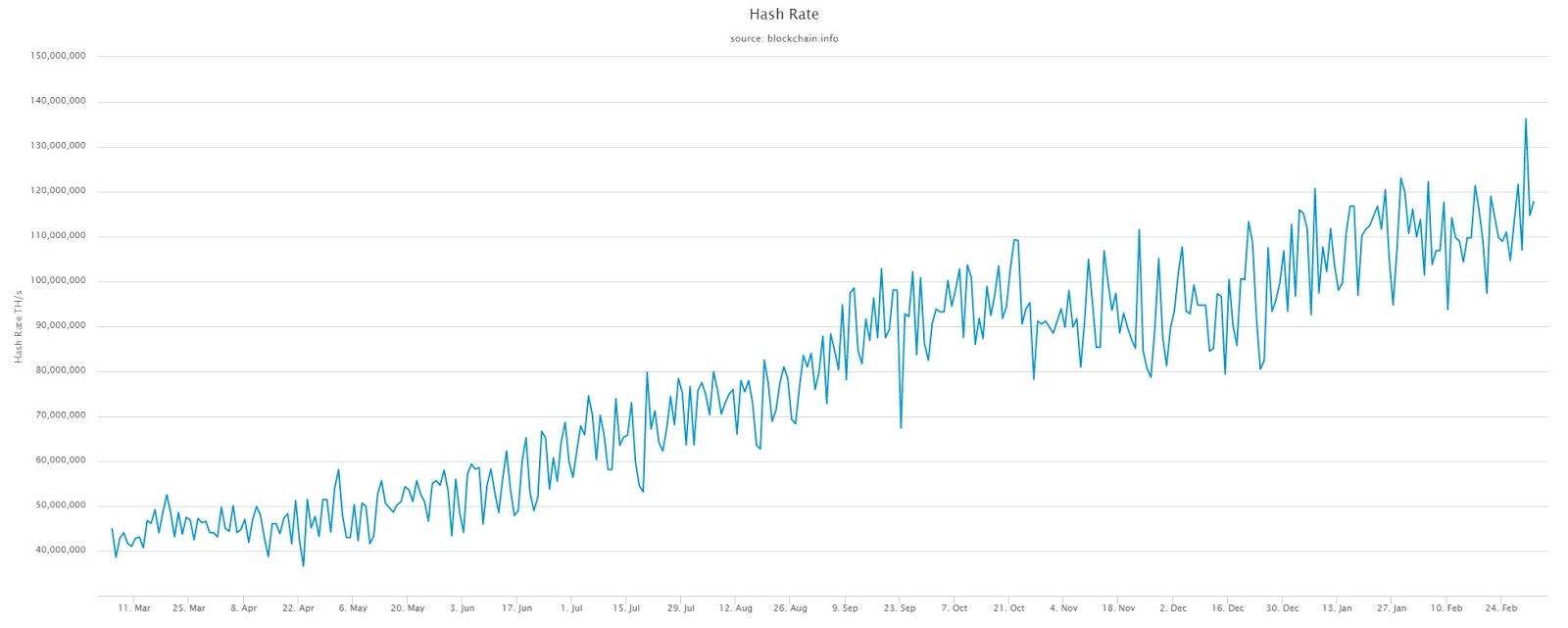

Seeing as large mining centers rely on improved mining equipment to achieve higher computing power for BTC mining, De La Torre said this could affect the hash rate of the Bitcoin network to some degree:

“This is more of a test of the mining manufacturers’ capabilities. The factories where all the parts are manufactured for these machines are in lock-down or are operating at a less than optimal capability. This will slow the production of mining rigs which in turn will affect the continued increase of the Bitcoin hash rate which then may cause some speculators to see this as a bearish signal.”

Source: blockchain.com

Source: blockchain.com

Once a Bitcoin halving takes place, this produces a need for new and improved mining equipment, as the previous ones are no longer powerful enough for mining. After every halving, miners had to replace the old equipment to be able to keep up with the new algorithm changes. If the quarantine rules extend even longer, this could greatly impact the capabilities of Bitcoin mining farms.

The outbreak will also put a hold on creating new ASICs, which prevents mining farms from being on par with the demand. This may reduce the hash power of the network and delay the Bitcoin halving a bit further.

Will the Market Benefit from the Bitcoin Halving?

When the past halvings occurred, the altcoin market cap saw a great increase in price, some even greater than BTC itself.

At the time of the first Bitcoin halving, the altcoin market cap went from $45.89 million in June 2013 to $2.02 billion in December 2013, which marks a surge of 4,302 percent. In the second halving, the altcoin market cap shot up from $1.74 billion in December 2016 to an all-time high of $555.91 billion in January 2018, recording an immense rise of 31,849 percent.

Source: Coinsignals.trade

Source: Coinsignals.trade

We also have to take into account other factors that might have caused the market cap to increase, but there is solid evidence to support the theory that the BTC halvings prompted the massive price surges across the overall crypto market.

A 2019 analysis showed that prices and volume of cryptocurrencies are highly correlated. This means if Bitcoin surges, then the rest of the cryptocurrencies are likely to replicate its momentum.

Other factors that influence cryptocurrency growth are media coverage and investor attention. One study concluded that Bitcoin saw greater returns when media outlets had more frequent posts about the coin and when Google searches increased.

This phenomenon was observed back in 2017, with media coverage increasing as Bitcoin was going up. As there have been more articles and news posts on Bitcoin, the number of people searching on Google also skyrocketed.

Source: Google Trends

Source: Google Trends

Conclusion

From its past Bitcoin halvings, it has been noticed that this type of event was the catalyst for a strong upward movement that propelled the overall cryptocurrency market. But considering other factors, such as the new Covid pandemic, slower hash rates, and the sudden drop of BTC, will the upcoming Bitcoin halving positively affect the market once again?

Featured image: CRIPTO TENDENCIA

coindoo.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube