Bitcoin has never been traded above $ 10,000 for an extended period of time. In addition, global crypto adaptation is also making a big leap forward. The market update.

The Bitcoin course (BTC) is turning up 2.6 percent on the daily basis and is continuing to soar. The largest cryptocurrency only briefly fell below $ 15,000 on the night from Saturday to Sunday before BTC regained the mark in yesterday’s trading session. With a weekly plus of 11.5 percent and a considerable increase in value of over 39 percent in the last 30 days, the Bitcoin price was quoted at 15,412 US dollars at the time of going to press.

Bitcoin has now been above the key psychological level of USD 10,000 for three and a half months, setting a record. Even during the bull run, when Bitcoin shot to its all-time high near $ 20,000, the digital currency was trading just under two months above value. In mid-June of last year, Bitcoin stayed just under three months above the mark, but then fell back significantly to $ 7,000. At least a look at the chart suggests that this time we are dealing with a more substantial bottoming out.

Market capitalization and Bitcoin dominance point the way up

The Bitcoin rally has not least brought fresh capital into the market. The increasing trading activities in the crypto market are reflected in the rapidly increasing total market capitalization, which is currently a two-year high at 434 billion US dollars. In the wake of the massive sell-off in mid-March, total market capitalization fell to $ 135 billion. In the past eight months, around 300 billion US dollars have flowed into the market.

Only in bull run times was the capitalization of the crypto market higher. At that time, the market briefly reached a capitalization of over $ 850 billion. But just as quickly as the market inflated, the ground was torn from under his feet again. It took just under a month at the end of 2017 to jump from $ 500 billion to $ 850 billion. However, it took just as long in early 2018 for the market to drop back to $ 500 billion. The fact that capitalization is growing continuously this time, but more cautiously, speaks for more sustainable and healthier growth than in the “golden” bull run era.

The old season and the rapid growth of the DeFi market have eroded the largest cryptocurrency in the summer slump. With a market dominance of currently 65 percent, Bitcoin is again flexing its muscles compared to the Altcoins and is building on the level before June.

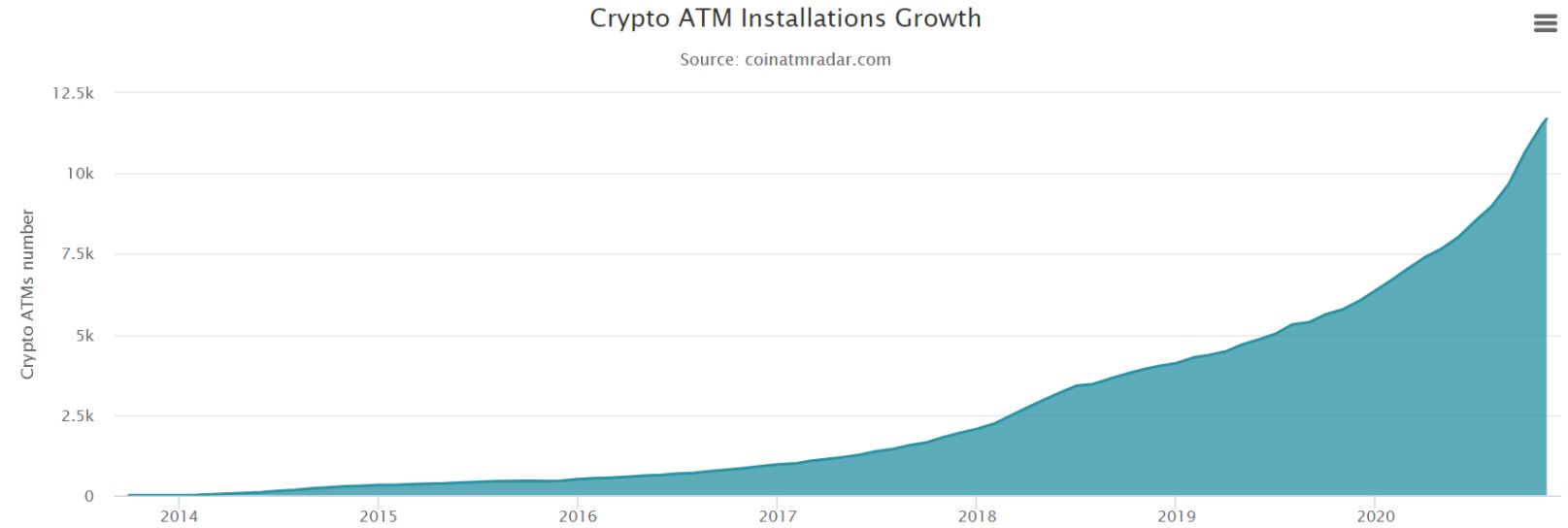

In terms of crypto adaptation, 2020 has been an extremely successful year so far. The biggest door opener in the direction of mass adaptation is the recently announced crypto integration of the payment giant PayPal. In addition, the number of Bitcoin ATMs is also increasing steadily.

While Coinatmradar counted almost 6,372 ATMs worldwide at the beginning of the year, the current figure is 11,697. In 2020 alone, 5,325 new ATMs went into operation. Broken down into the days, there are almost 17 ATMs added every day.

With currently 38 registered ATMs, Germany is not exactly one of the largest ATM locations. The USA, on the other hand, has by far the most Bitcoin issuing offices with 9,493 ATMs. Compared to the USA, Canada ranks second with 962 ATMs and Great Britain with 289 ATMs in third place in the country ranking.

Picture by Pixabay

[newsletter_form lists="1"]