- After bottoming at $10,200 earlier this month, the cryptocurrency has ripped higher.

- Bitcoin now trades just shy of $12,000.

- Bitcoin will need to close above $11,828 on a weekly time frame if it is to confirm its macro bullish trend

Bitcoin Crosses Pivotal Macro Level

Bitcoin has pushed strongly higher over the past two weeks. After bottoming at $10,200 earlier this month, the cryptocurrency has ripped higher, as it now trades just shy of $12,000. Earlier this hour, the cryptocurrency passed that pivotal resistance level as buyers stepped in.

While BTC still sits below $12,000, analysts remain bullish as Bitcoin holds above another crucial level.

That level in question is $11,828.

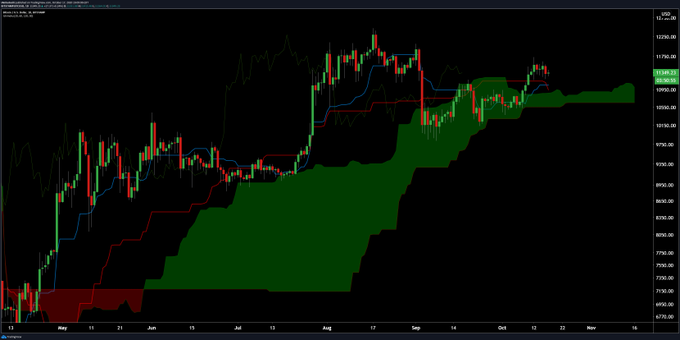

One crypto trader and chartist shared this chart amid the rally higher. It shows that since early 2018, that level has been of absolute importance to Bitcoin bulls, marking the highs multiple times in 2018, in 2019, and even earlier this year during the summer breakout.

Bitcoin will need to close above $11,828 on a weekly time frame if it is to confirm its macro bullish trend. That will be decided on Sunday evening, when the close comes in.

Chart of BTC's price action over the past three years with analysis by crypto trader "Nunya Bizniz" (@pladizow on Twitter). Source: BTCUSD from TradingView.com

Expect a Bullish Followthrough

Analysts think that this is the start of a greater move higher.

Crypto-asset trader Josh Olszewicz recently shared the chart below. It shows that Bitcoin’s Ichimoku Cloud indicator recently formed a pivotal buying signal. This signal was last seen during the late-July rally that took Bitcoin from the $9,000s to $11,000 and beyond.

His analysis of the indicator shows that since 2013, it has had an 80% hit rate in calling Bitcoin bull trends. For one, it managed to mark the start of the rally to $20,000 after the China FUD in late 2018, which sent the asset lower by 30-40% in just a week’s time.

Chart of BTC's price action over the past few months with analysis by crypto trader Josh Olszewicz. Source: BTCUSD from TradingView.com

On-chain trends also favor Bitcoin bulls. Citing data from blockchain analytics firm CryptoQuant, a crypto-asset analyst recently shared some of these on-chain trends, which are as follows:

- The “exchange whale ratio,” which tracks how much Bitcoin large holders have deposited on exchanges, is currently at notable lows.

- Miners are not sending coins to exchanges en-masse, meaning they likely aren’t selling the coins directly or are selling their positions through OTC.

- The market capitalization of stablecoins has exploded higher over recent months.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bitcoin's Latest Leg Higher Brings It Above a Crucial Macro Level

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube