- Ethereum’s price has rocketed over the past few days alongside Bitcoin, but it has been underperforming the benchmark crypto

- While Bitcoin is currently on the brink of setting fresh yearly highs, ETH is trading down significantly from its $490 highs that were set a couple of months ago

- For ETH to outperform BTC, there will likely have to be a resurgence in the DeFi space

- This will drive transactional volume and buy-side pressure for ETH and help it rocket higher

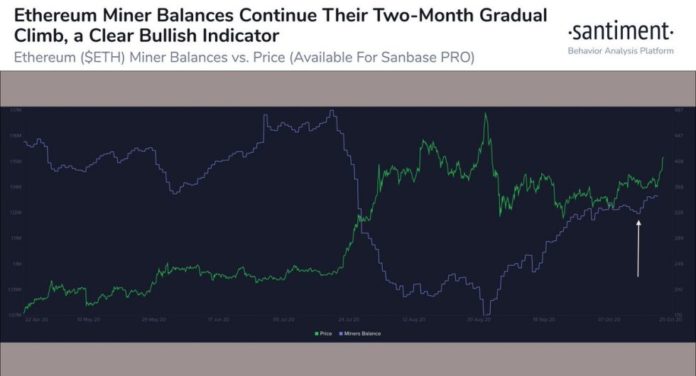

- One positive development that may boost Ethereum is the fact that its miners haven’t been selling into this recent rally

Ethereum and the entire crypto market have been caught in the throes of an intense uptrend throughout the past few days thanks to Bitcoin’s rally past $13,000.

ETH is still underperforming the benchmark crypto slightly, but this could change rapidly if there’s any catalyst for gains – like a phase 0 rollout of ETH 2.0 or a resurgence in DeFi trading activity.

One bullish trend that could boost Ethereum is that its miners have not been selling into this rally – suggesting that they anticipate it to see further upside.

Ethereum Rallies Alongside Bitcoin, But Underperformance Persists

At the time of writing, Ethereum is trading up just under 2% at its current price of $416. This is around the price at which it has been consolidating following its recent rejection at $420.

This is the near-term resistance level that must be surmounted. A firm break above this level could spark a buying frenzy that helps push its price up to new highs.

For it to outperform Bitcoin, it will have to post some sharp gains in the near-term.

Analytics Firm: ETH Miners Holding Steady Despite Recent Gains

Despite ETH’s intense gains as of late, its miners are holding steady and aren’t showing any signs of selling into it.

One analytics platform spoke about this trend, saying:

“The good news is that miners aren’t selling, and there is a big increase in new ETH addresses being created, and pre-existing addresses have shown an increase in activity.”

Image Courtesy of Santiment.

Unless miners start offloading their Ethereum in the near-term, their current holding pattern takes some serious pressure off its price and could open the gates for further upside.

Because Bitcoin is currently testing its 2020 highs, it does seem as though upside is imminent for the aggregated market.

Featured image from Unsplash. BTCUSD pricing data from TradingView.

Bitcoinist.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube