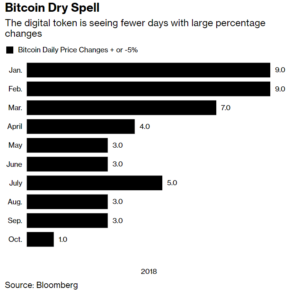

Bitcoin’s price volatility has dropped dramatically in recent months, and experts interviewed by Bloomberg believe the low volatility could be an indication that Bitcoin has hit bottom. In the last month, Bitcoin’s price has moved more than 5 percent in a single day only once, in contrast to nearly 10 of these types of swings in January and February.

This could be a sign of “speculation leaving the market and eventually a bottoming process,” said Bloomberg Intelligence analyst Mike McGlone. “High volatility is a major factor lessening most cryptocurrency use cases for anything other than speculation.”

“It simply means the market is calm and in balance. That implies that speculative interest is low,” said Charlie Morris, multi-asset head at Atlantic House Fund Management in London in an email to Bloomberg. “Given this bear market is now 10 months old and is getting tired, I’d be inclined to be bullish for the next major move.”

Bitcoin’s price has fallen more than 50 percent this year. Down from its high of $19,511 in December of 2017, Bitcoin has been holding steady at around $6,300 this month. The world’s leading cryptocurrency fell below $6,000 in August, but hasn’t sunken below that threshold since June.

While Bitcoin has historically been criticized for its wild market volatility, an increasing number of reports suggest that digital money’s unpredictable market trends could be reaching an end. Recent data coming from CBOE Global Markets show that the 20-day historical volatility of Bitcoin has fallen to 31.5 percent. This is lower than many major companies, including Amazon (35 percent), Netflix (52 percent), Nvidia Corp (4o percent) and Domino’s Pizza (36.2 percent).

Kevin Davitt, a senior instructor at The Options Institute at CBOE, told Market Watch that the low market volatility may indicate a “new normal” for Bitcoin.

“Perhaps we are witnessing the maturation of a market. It’s far too early to declare this the ‘new normal’ but the persistent range over the last few weeks may be hinting at a structural shift. Time will tell,” Davitt said.

Bloomberg Intelligence commodity strategist Mike McGlone echoed these sentiments, stating that the digital money market is rapidly maturing. He added that we are unlikely to ever see the wild price volatility that characterized late-2017 ever again.

“This is a maturing market, so volatility should continue to decline,” McGlone said. “When you have a new market, it will be highly volatile until it establishes itself. There are more participants, more derivatives, more ways of trading, hedging and arbitraging.”

“The cost of the emotional traders has been washed away by the recent crash, and with it a lot of the volatility,” said Danial Daychopan, chief executive officer of Plutus, an app that allows crypto transactions.

Unhashed.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube