Dark pools and high-frequency trading (HFT) are topics that have gained both a lot of controversy and attention in the financial world.

High-frequency trading with cryptocurrency has also started gaining traction, as digital assets are the newest form of investment on the market, and everyone is looking at how to make some profits of it.

We will be explaining what dark pools and high-frequency trading are, and how they apply to cryptocurrency in our trading for dummies guide.

High-Frequency Trading: What Is It?

High-frequency trading is a form of trading that uses algorithms and software which execute thousands of high-speed trades automatically within the trading day. From this perspective, it is quite similar to crypto trading bots.

High-frequency trading rose to popularity with the advent of internet and software development. Thus, HF trading, which was at first reserved to just institutions and hedge funds, became available to the ordinary retail investor.

Although at this point, HFT is still new to the crypto market, many companies that engage in HFT have started getting involved in digital assets.

Source:Dollarsandsense

Source:Dollarsandsense

The Basics of High-Frequency Trading

We will be delving into the fundamental traits of a high-frequency trade, so that you will have more insight into the tactics and trading strategies used by this type of traders. Here are some of the basic principles:

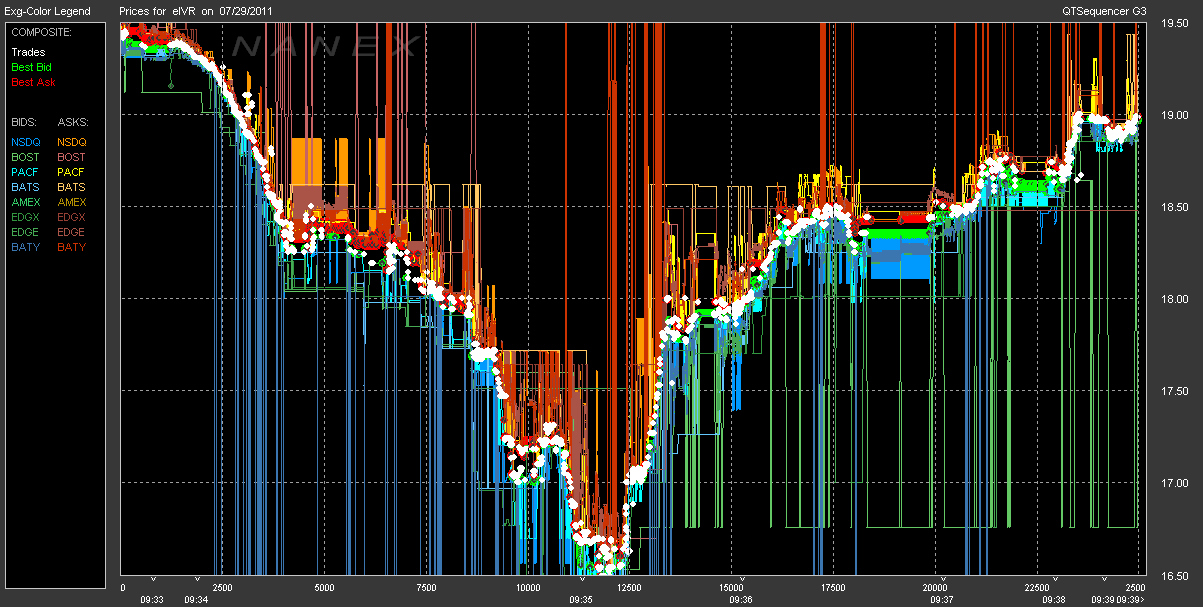

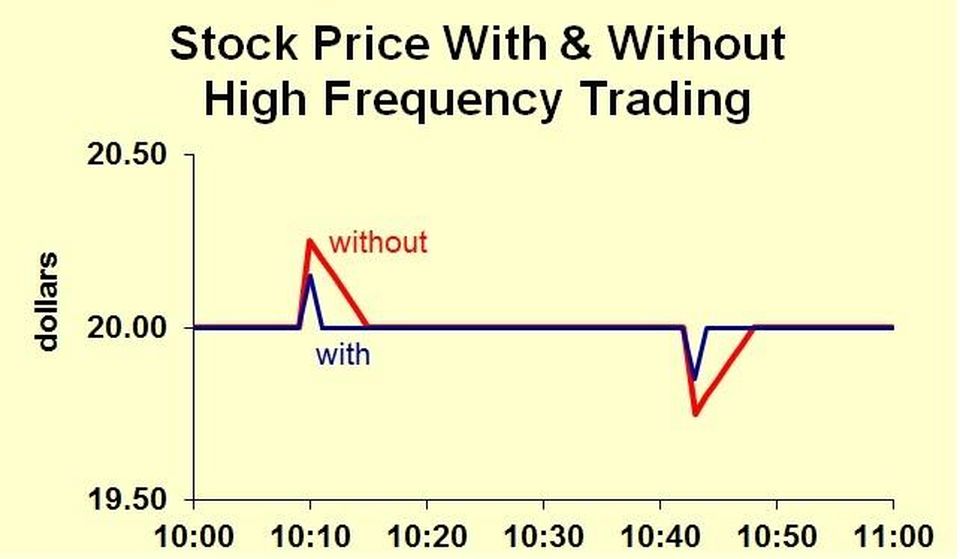

- High-frequency trading in cryptocurrency and financial markets is often correlated to flash crashes. Just like their name suggests, flash crashes occur in a matter of seconds or milliseconds. This happens because high-frequency traders are placing huge amounts of sell orders.

- Dark pools and high-frequency trading. HFT operates in dark pools, which allows them to be indistinguishable from other traders. If you are trading against an HFT, you might end up having your order executed at an inferior price (more on dark pools later on in our trading for dummies guide).

- High-frequency trading is executed in lots of 100 to 200 shares. By using small orders, investors test the market to find out the big orders hidden in the markets.

- Monitoring stock price slippage. Slippage is the difference between the price of a stock or crypto when you place an order and the price your order is actually executed. A consistent slippage rate trades indicate that high-frequency traders are on that asset.

- High-frequency traders employ a number of different strategies. They make use of traditional market-making and trading strategies in addition to automated trading.

- High-frequency trading fluctuates according to regulatory changes. Any changes in regulation will affect how the investors place their orders and, thus, how the market works.

Regular crypto day traders can now also implement their own high-frequency trading strategies and algorithms without requiring established hedge funds or high-end software. The development of cryptocurrency trading bots allows traders to use various sophisticated algorithms that enable them to compete with established institutions.

cryptocartel.club

cryptocartel.club

What Are Dark Pools?

Dark pools are private markets where trading exchanges or forums do not display the bids and offers made, and they are predominantly used for trading securities. Dark pools cannot be accessed by the public investor.

Even if these exchanges are known for their complete lack of transparency, this does not mean that they do not have trade reports. Many regulators from different countries require these exchanges to keep a report of trades.

Dark pools originated at first to allow institutional investors to block trade without impacting the market with their large orders and affect the prices in a way that would be detrimental to their trades.

Dark Pools and High-Frequency Trading

If you take a look at the current crypto market, you will observe how big sell or buy orders on regular exchanges affect the prices of all altcoins. How can high-frequency trading in cryptocurrency change this? Let’s explain the appliance of this concept in our trading for dummies guide.

Well, if an institutional investor uses a dark pool to sell a large amount of crypto or share of a block, the lack of transparency may help the investor get a more favorable price than if the sale was made using a regular exchange. As dark pool participants do not reveal their trading purposes to the exchange before execution, no order book can be seen by the public. The details of the trade are only released to the consolidated tape later after the trade has been executed.

The institutional seller thus has a much better chance of finding a buyer for the full amount in a dark pool, as it is only reserved for large investors. This also gives the investor the chance of getting a better price in the mid-point of the quoted bid and ask price that is employed for the transaction.

But this type of price change can only happen if it is assumed that the investor’s proposed sale does not leak beforehand and that the dark pool is not susceptible to high-frequency trading (HFT) predators who could execute front-running once they figure out the investor’s trading intents.

By routing the trades via a dark pool, this exposes you to the possibility of being front run and having your information leaked. When an order is first sent through a dark pool, the order information is leaked all the time.

The type of order, the price information, and the amount of crypto or stocks in the order are all valuable information to other traders. High-frequency traders can make use of the information that is routed electronically, which can then picked up or even given to other market participants.

markettraders.com

markettraders.com

Dark pools and High-frequency trading in cryptocurrency can have the following advantages:

- Significantly lower impact of large orders on the market impact;

- Lower transaction costs, as there are no exchange fees, and bid-ask midpoint transactions do not incur the full spread;

- HFT can use the information they have on dark pools to place orders to their advantage.

However, there are some disadvantages, mainly for those who do not engage in high-frequency trading:

Exchange prices may be different from the ones featured in the real market. If dark pool trading by broker-dealers and electronic market makers keeps on growing, the features of the price on exchanges may not reflect the actual market. For example, if a small investor buys share or crypto and the fund’s sale later becomes public knowledge, his asset’s price will drop significantly.

Pool participants might not get the most favorable price. As dark pools are transparent, this can also work against a pool participant as it isn’t guaranteed that the institution’s trade was made at the best price.

Source: Forbes

Source: Forbes

HFT traders can employ predatory tactics, such as “pinging” dark pools to find large hidden orders and then using front-running or latency arbitrage.

The recent HFT involvement in dark pools has also attracted the attention of financial regulators. Regulators have always been wary of dark pools because of their lack of transparency, and the controversy of their use may generate renewed efforts to discourage investors from using dark pools.

Trading for Dummies: Conclusion

HFT Institutional and retail investors alike will continue to be interested in the crypto market due to its increase’s volatility. The use of dark pools and high-frequency trading in cryptocurrency is still seen as controversial, as many blame this practice for generating more volatility and placing slower traders as a disadvantage. Nevertheless, this type of trading method will most likely continue to be practiced on the crypto market.

Featured image: coindesk.com

coindoo.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube