The latest annual report of the International Monetary Fund has concluded that cryptocurrency does not pose a threat to global economic stability. Or at least not yet.

Every year the IMF published a report detailing the economic state of the world. This year’s is entitled “A Bumpy Ride Ahead” and features a chapter on cryptocurrency.

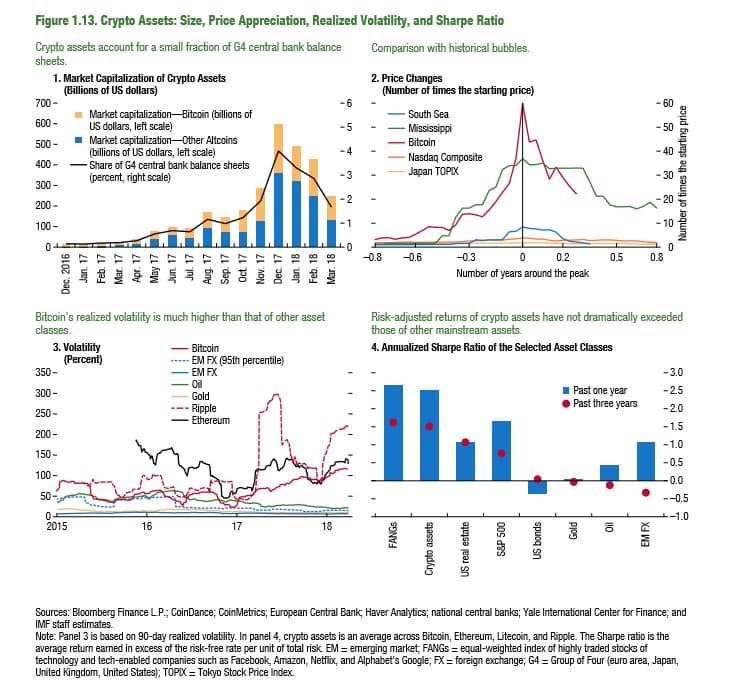

The report explains that despite the “spectacular appreciation” of crypto-assets over 2017/18, their total market value is less than 3 percent of the combined value of the balance sheets of the four biggest banks in the world. Even at the peak of their popularity, they barely hit 6 percent.

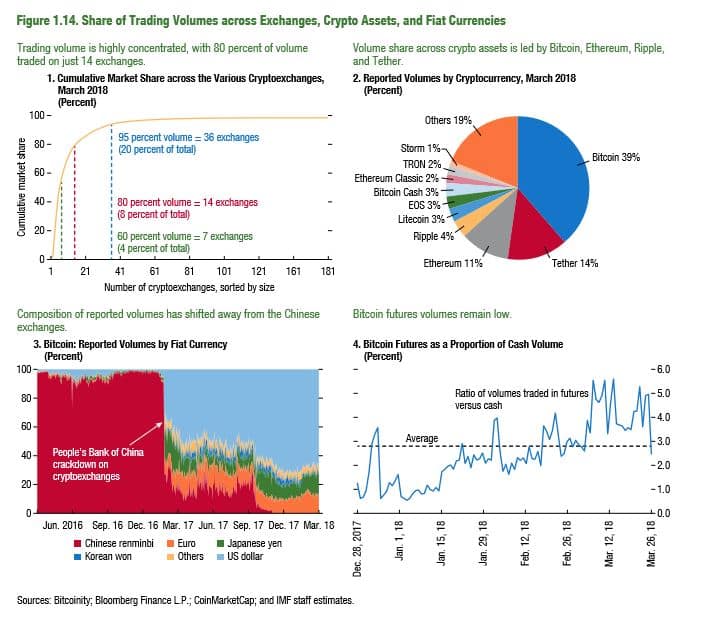

The report notes that the industry is still very concentrated; Bitcoin, Ethereum and Ripple account for 80 percent of all cryptocurrency market capitalisation – Bitcoin alone makes up 47 percent. Although there are more than 180 active cryptocurrency exchanges throughout the world, more than 80 percent of trading is conducted at the top 14. Surprisingly, the IMF calculated that an investor would have made more money from FANG stocks (Facebook, Amazon, Netflix, Google) than crypto-assets over the last three years.

Moreover, the groundbreaking release of Bitcoin futures by the Chicago Mercantile Exchange and Chicago Board Options Exchange in December 2017 has not had as big an effect on the world as was expected by some: “…futures volumes represent a small fraction of overall trading activity on the CME and CBOE and only 2.3 percent of reported trading in the Bitcoin cash market on [cryptocurrency exchanges]…”

For these reasons the IMF has concluded that cryptocurrency poses “limited threat” to the fiat financial system. This is less a vote of confidence than an understanding that the relevance of cryptocurrency is in real terms much less than what media hype has made it out to be. The report does however add that the sector “warrants vigilance by regulators” because of its dramatic growth.

Overall, the impression is of an industry which is still a bit more niche than it would like to consider itself.

On a more positive note, the report is optimistic about the future application of blockchain technology: “The technology underlying crypto assets—distributed ledger technology (DLT)—could also lead to more efficient market infrastructure.”

It adds: “Future policymaking will need to be nimble, innovative, and cooperative. The IMF can help advance the agenda on regulation of crypto assets by offering advice and by serving as a forum for discussion and international collaboration.”

The IMF was created in December 1945 as part of the Bretton Woods agreement. Its function is to maintain international economic stability by providing advice and by issuing loans. It has 189 member states and controls a fund of $668 billion. It is headquartered in Washington D.C.

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube