The views expressed here are the author’s own and do not necessarily represent the views of Cointelegraph.com

Ethereum has four milestone phases in its development post-release; Frontier, Homestead, Metropolis, and Serenity. Ethereum is currently in phase three – Metropolis version Byzantium. However, Ethereum has had a difficulty bomb – a protocol that makes mining the cryptocurrency more difficult – programmed into its Blockchain since the Frontier phase.

Why program a difficulty bomb?

Ethereum’s final milestone phase is Serenity. A major change that comes with Serenity is that Ethereum’s Blockchain consensus algorithm will change from proof-of-work (PoW) to proof-of-stake (PoS). Before the Ethereum network is able to make the shift from PoW to PoS, the network has to shift miners off of the PoW Blockchain, onto the PoS Blockchain.

For the Ethereum network to continue functioning with full support, miners will have to support the PoS Ethereum Blockchain and not the chain that will proceed with a PoW protocol. This is a bit confusing – and that is exactly why developers programmed a difficulty bomb into Ethereum’s Blockchain, to eliminate any confusion.

The difficulty bomb

The difficulty bomb was first mentioned on August 4, 2015 in a blog post by former Ethereum’s chief commercial officer Stephan Tual that announced the first patch to Frontier.

“A lot of you have been wondering how we would implement a switch from PoW to PoS in time for Serenity. This will be handled by the newly introduced difficulty adjustment scheme, which elegantly guarantees a hard-fork point in the next 16 months … it works as follows: starting from block 200,000 (very roughly 17 days from now), the difficulty will undergo an exponential increase, which will only become noticeable in about a year. At that point (just around the release of the Serenity milestone), we’ll see a significant increase in difficulty which will start pushing the block resolution time upwards.”

The protocol to increase mining difficulty was introduced to the Ethereum network on Sep. 7, 2016. Tual estimated that by December 2016 the time for verifying a block would be so slow that it would be as if activity on the Ethereum network was frozen.

This is how the difficulty bomb got its nickname ‘the ice-age bomb’, or why it is sometimes referred to as “the Ethereum ice age”. However, come Dec. 2016, the block times had not become exponentially lengthier. In March 2017, the co-founder of Ethereum, Vitalik Buterin, posted on Reddit regarding the difficulty bomb:

“As it turns out, with the change in the difficulty adjustment algorithm brought about in the last hard fork (Homestead), the ice age will come very slowly indeed. From block 3.5 mln, we will have an average block interval of 25 seconds for about 100,000 blocks (about 1 month).

Then we will have 35 seconds for the next 100,000 blocks (about 1.4 months), then ~ 55 seconds for about 2.2 months, then ~95 sec. for about 3.8 months, and so on until we reach ~ 655 seconds for about 26 months…The final doom does not take place until 2021 (though it certainly gets very annoying by the second half of 2017).”

However, in Oct. 2017 the ice age was postponed once again. The Oct. 16 hard fork that upgraded the network to Metropolis delayed the difficulty bomb by 42 mln seconds (1.33 years). Around the end of 2018 miners can expect to start seeing 30 second block times.

Avoiding the Ice Age?

If the Ethereum network is beginning to feel the effects of the difficulty bomb in the latter part of 2018, we would most likely see Ethereum hard fork to the next milestone, Metropolis v. Constantinople, which would be the first milestone version to introduce the PoS system to the Ethereum Blockchain. Although a majority of the transactions on the Ethereum network will remain PoW, every 100th transaction will be PoS in Constantinople, which will lay the groundwork for Casper, the PoS system used in Serenity – Ethereum’s final milestone.

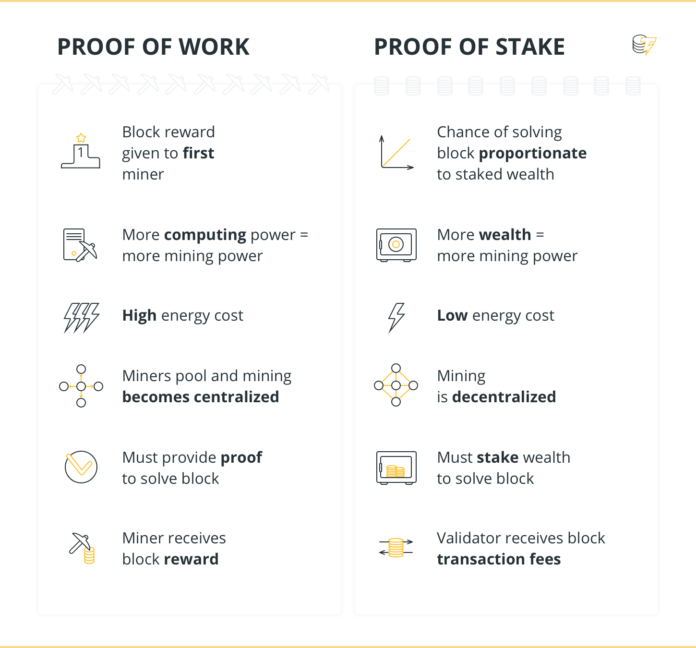

Proof of Work vs Proof of Stake

In a PoW system, computers race to solve algorithms. The computer that solves the algorithm first and broadcasts the new block to the network gets rewarded newly minted coins and the transaction fees from the block. Because the reward is given to the first computer to solve the algorithm, miners have an incentive to use as much computing power as possible so that they can solve the algorithm and receive the block reward before their peers can. However, the trade off for having more hash power – the ability to solve the algorithm faster – is that miners expend more resources and pay more in electricity costs to run their mining rig(s). The more computing power a miner uses, the more energy it will take to run the miners computer(s).

In a PoS system, nodes referred to as bonded validators can stake their money on the blocks added to the Blockchain. The percentage of wealth staked relative to the market cap represents the percentage chance an individual has of creating the block and receiving the transactions fees contained in it.

A bond validator staking their funds can be thought of as an individual making a security deposit. If the blocks they stake their funds on are valid, they will receive their stake back, if fraudulent, the bond validator will lose their stake. Since bad actors are severely punished for supporting invalid blocks, individuals have more incentive to act honestly than they do in a PoW system.

Blockchain Architect David Duccini told Cointelegraph:

“The mining process in part is keeping a downward price pressure on the coin base as miners must flip their coins into fiat currency to pay for electricity and upgrades to their mining hardware. They are selling their coins largely to speculators. In a PoS based chain, the coin holders get rewarded directly and in proportion to the number of coins they hold.”

Energy cost

In a PoS system, the energy cost of mining is far lower than it is in a PoW system; bond validators stake their funds on blocks rather than race their hardware to solve an algorithm. Michael Gord, founder of MLG Blockchain told Cointelegraph:

“A PoS network is always more efficient than a PoW network. A PoS network is secured by users holding tokens on the network rather than users contributing computing power which is what secures a POW network.”

In a PoS system there is no advantage in having expensive mining equipment that can solve algorithms faster than your peers mining equipment can. This means that there is no need to incur high electricity costs to try and support the network.

Duccini says that because PoS is more efficient, it is superior to PoW:

“PoS is superior because it is both low energy due to the fact that the thing ‘spent’ is not electricity but rather ‘coin age’ and two, [because] you have actual stakeholders in the purest sense of the word who care about the long term viability of the chain versus someone who is just in it for quick cash.”

The PoS system also makes it more difficult and expensive to conduct a 51 percent attack. In a PoS system you would need to purchase 51 percent of the Ethereum market cap – a feat that not many individuals have the funds to accomplish. While to conduct a 51 percent attack in a PoW system, an entity has to gain control of 51 percent of the mining power – which has already happened before: in July 2014, a bitcoin mining pool named Ghash had 51 percent of the mining power on the Bbitcoin network for 12 hours.

Source: Blockchain.info

“In the extreme cases, mining has become “weaponized” — turning otherwise reasonable people into “economic terrorists” where underpowered chains are attacked.”

Blockchain Architect David Duccini

Because Ghash had control of 51 percent of the mining power, they had the ability to control the transactions on the network, and double-spent coins.

Is a PoS consensus algorithm fair?

|

Wealth in Ether (dollar USD) |

Percentage chance of solving block |

|

1.00 |

0.00 percent |

|

10.00 |

0.00 percent |

|

100.00 |

0.00 percent |

|

1,000.00 |

0.00 percent |

|

10,000.00 |

0.00 percent |

|

100,000.00 |

0.00 percent |

|

1,000,000.00 |

0.00 percent |

|

10,000,000 |

0.03 percent |

|

100,000,000 |

0.27 percent |

|

1,000,000,000 |

2.67 percent |

|

10,000,000,000 |

26.69 percent |

A problem that some people say is concurrent with a PoS system is that in such a system the rich will only get richer. Individuals with more wealth on the Blockchain have better chances of creating a block and receiving the transaction fees contained there than individuals with less wealth.

If you stake 20 percent of the Ethereum market cap, you have a 20 percent chance of creating a block and receiving the transaction fees contained in a block, if you stake .005 percent you have a .005 percent of creating the block and receiving the transaction fees contained in a block.

With that being said, is a PoS system really any different from a PoW system in terms of economic structure? In a PoW system individuals who can afford to spend more on computing power (the rich) are able to mine more resources (Bitcoin) then those who cannot afford to purchase as much computing power (the poor). It seems like either way, PoS or PoW, the rich get richer while increasing the distance between themselves and the less wealthy with each new block created.

Serenity

The PoS system will be in full swing by the time Ethereum upgrades to Serenity, the final milestone in Ethereum’s roadmap. At the Serenity phase, Ethereum will be a Blockchain business with a built-in turing-complete programming language that can be used by other developers, companies, and entities to create contracts, applications, and systems. In a presentation in 2017, Ethereum developer Hudson Jameson discussed Ethereum’s roadmap. Although Hudson did not give an estimate of when Serenity would be released, he did say that when Serenity is released “this is going to be when you know the really big stuff hits”.

Ethereum is one of the Blockchain networks that more closely resembles a business than a lot of the other Blockchain networks and Blockchain-related companies offering digital assets. Ethereum’s four phase roadmap and white paper make it very clear what the company intends to accomplish. Ethereum white paper reads:

“What Ethereum intends to provide is a Blockchain with a built-in fully fledged Turing-complete programming language that can be used to create “contracts” that can be used to encode arbitrary state transition functions, allowing users to create any of the systems described above, as well as many others that we have not yet imagined, simply by writing up the logic in a few lines of code.”

In other words, Ethereum’s goal is to provide a service that allows other Blockchain related companies to create whatever sort of application, product or system that they desire through programming. It is kind of wild to think that the value of a entity that is not even 75 percent toward its roadmap destination was valued at $1,430.81 on January 13, 2018. But with that being said, Hudson’s comment on Serenity starts to make a lot of sense.

Cointelegraph.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube