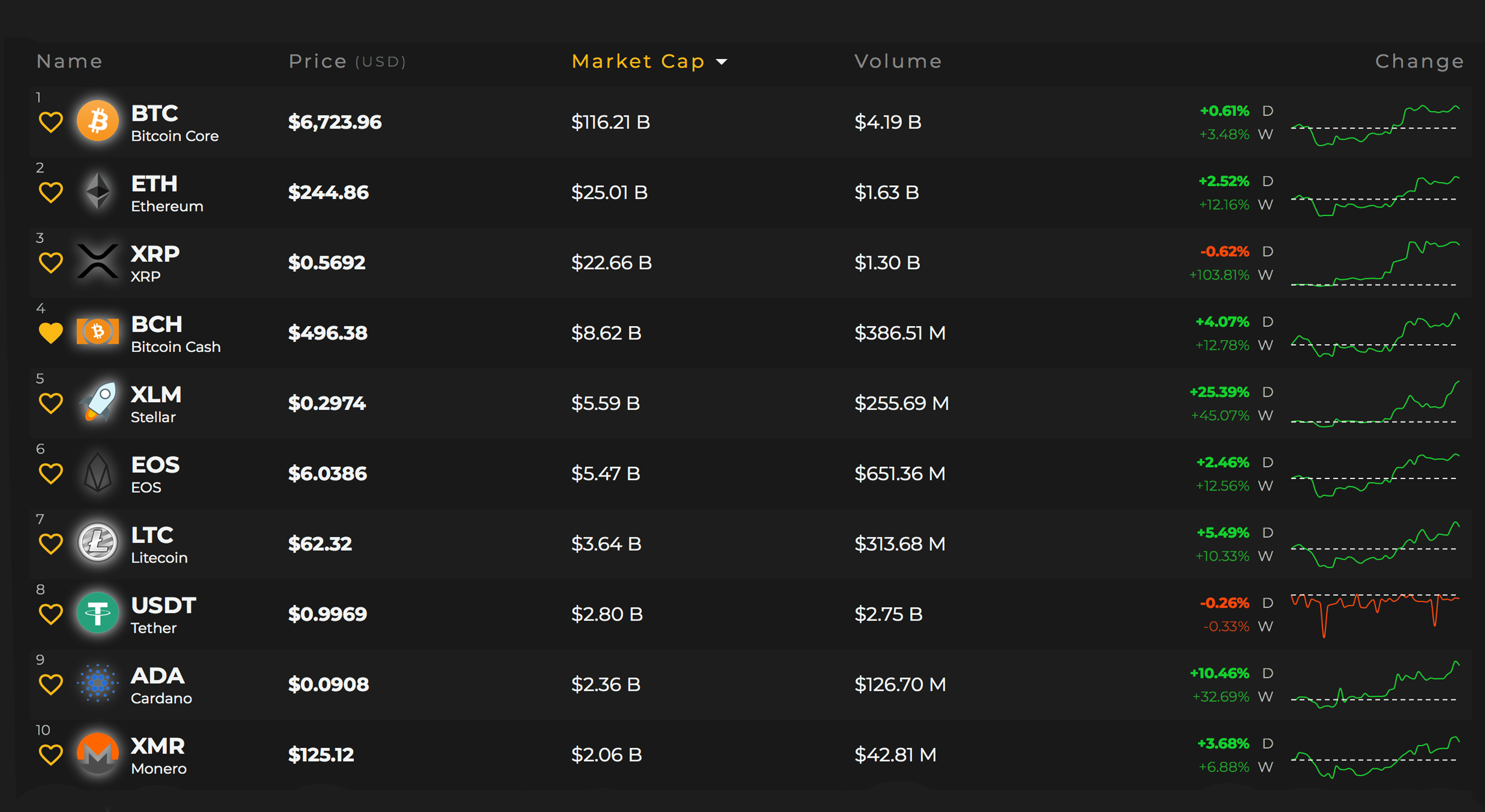

A few days ago digital asset markets saw some good gains pushing the entire crypto-economy up past $229 billion. Both bitcoin cash (BCH) and bitcoin core (BTC) had nice percentage spikes with BCH up 13 percent, and BTC up 3.5 percent over the last week. However, the biggest gainer this week was ripple (XRP) jumping over 103 percent over the course of the past seven days.

Cryptocurrency Markets Rebound and Consolidate

It was a weird week in cryptocurrency land, to say the least. During the last seven days, digital asset enthusiasts heard about the Securities Exchange Commission’s (SEC) deciding to hold off on the Vaneck/Cboe ETF decision until they get further commentary. Then a critical exploit that could have caused massive inflation was found in the Core reference client (and many other implementations) by a BCH developer. Lastly, the Japanese exchange Zaif revealed this week it lost close to 6000 BTC in a hack. Now one would think all of these things would affect cryptocurrency markets in a negative way. On the contrary, digital currency markets spiked in value as a great majority of coins saw seven-day gains.

The Top Crypto-Markets

Bitcoin core (BTC) markets over the last week are up 3.4 percent (US$6,723) and the cryptocurrency’s market valuation is around $116.2 billion today. Ethereum (ETH) markets shot up pretty good this week as one ETH ($244) has gained 12 percent. Of course, the cryptocurrency crowd witnessed the 103 percent increase ripple (XRP) markets experienced this week. One XRP is valued at $0.56 this Sunday and the coin’s market capitalization is about $22.5 billion. Bitcoin cash (BCH) markets are up 13 percent per BCH ($492) over the last seven days and the currency’s market valuation is about $8.5 billion this weekend. Lastly, EOS is priced at $5.45 and the EOS market performance over the last weeks is up 12.2 percent.

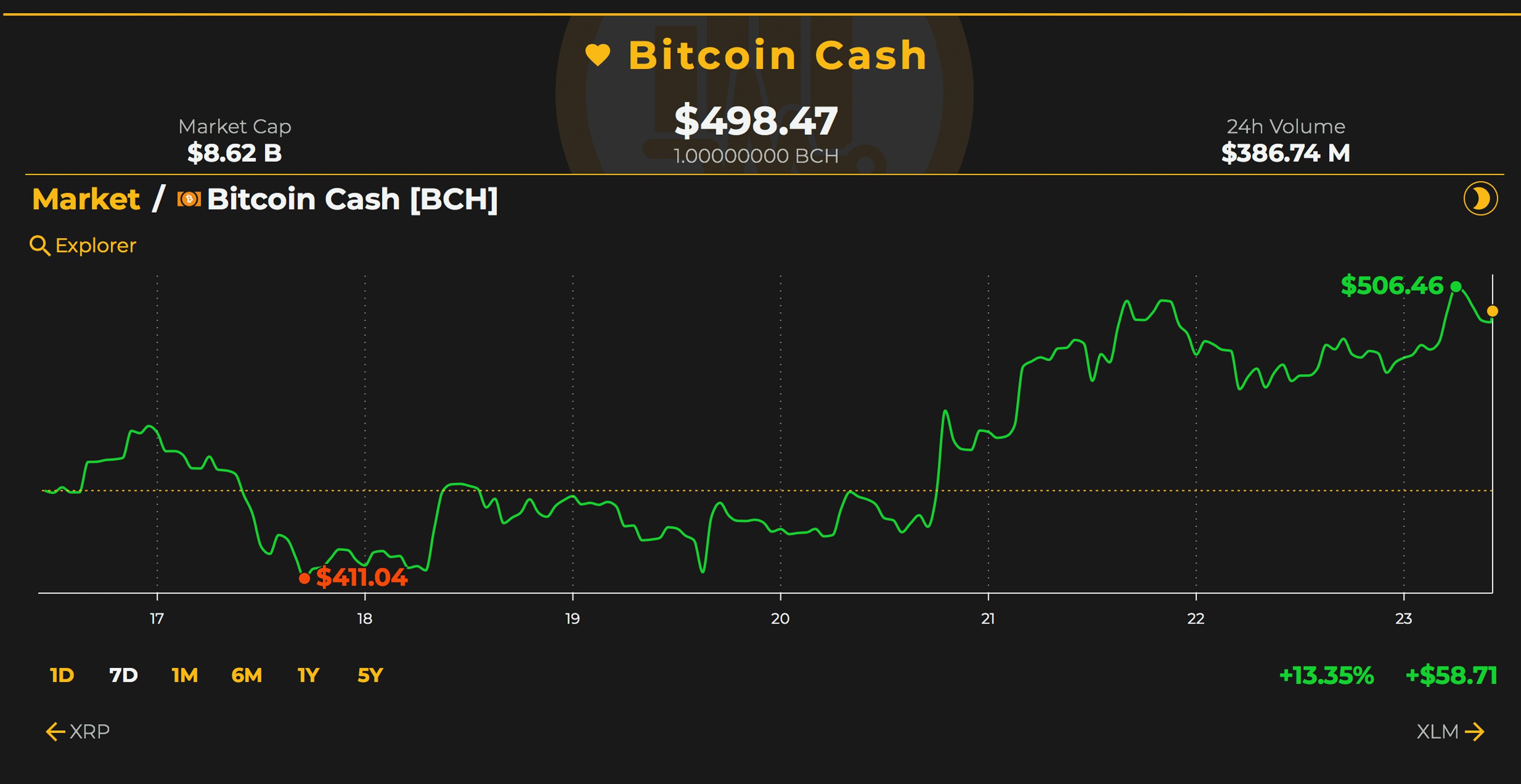

Bitcoin Cash (BCH) Market Action

Bitcoin cash market action today is showing the spot price hovering at $492 per coin but this Sunday BCH is up 3.12 percent over the past 24 hours. Over the last week, BCH dropped to a low of $411 on September 17 and went back to a high of $501 on the 21st. The top bitcoin cash swapping exchanges today are EXX, Lbank, Hitbtc, Okex, and Huobi. The top currency pairs traded for bitcoin cash this weekend include BTC (51.8%), USDT (30.8%), ETH (6.9%), USD (5.1%), and KRW (2.3%). Bitcoin cash markets hold the sixth highest trade volumes today below eos (EOS) and above litecoin (LTC) volumes.

BCH/USD Technical Indicators

The BCH/USD daily and 4-hour charts on Bitfinex and Binance indicate bulls are showing some signs of tiring out. We saw a big spike by the BCH bulls but it hit large resistance as markets gathered near 200 MA and corrected. Today, looking at the BCH/USD 4-hour chart, the 200 Simple Moving Average is above the 100 SMA trendline showing the path towards the least resistance is towards the downside. The 4-H RSI (61.6) shows the bulls may be exhausted and we could see some more sell off before another attempted upper leg jump. Order books show there’s some heavy resistance from here until $570 and another pitstop around the $590-630 range. Looking behind us we can see some foundational support between now until the $425 range and bears will be stopped there for a good period of time.

The Verdict: Despite Some Setbacks, Market Confidence Seems to Be on the Rise

Overall market confidence seems to be on the rise despite the recent BTC inflation bug and the SEC’s recent announcement to push off the decision to approve or deny the Vaneck/Cboe ETF. BTC/USD shorts, however, are very high still with over 30,000 short positions but ETH/USD short contracts have dropped significantly lower after touching their ATH. ETH/USD shorts have been cut from 26,000 on September 17 to just over 12,000 today.

Charles Hayter, the co-founder and CEO of the cryptocurrency data website Cryptocompare, believes last week’s ETH drop shook up market sentiment. “The fall in ethereum has spooked the market,” Hayter details. However, on a more positive note, Hayter emphasizes “there are multiple incumbent financial institutions looking closely at the space.”

Digital asset trade volumes have increased as this weekend has seen trade volume between $13-15 billion USD over the last 48 hours. This weekend’s verdict is far more optimistic than last weekend but it’s likely we will see some heavy consolidation and some corrections before the next level up, unless bears regain their strength.

Where do you see the price of BTC, BCH, and other coins headed from here? Let us know in the comment section below.

For the latest cryptocurrency news, join our Telegram!

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube