According to the Cardano network’s website, the network is “more than just a cryptocurrency.” “It is a technological platform that will be capable of running financial applications currently used every day by individuals, organisations and governments all around the world,” the landing page explains.

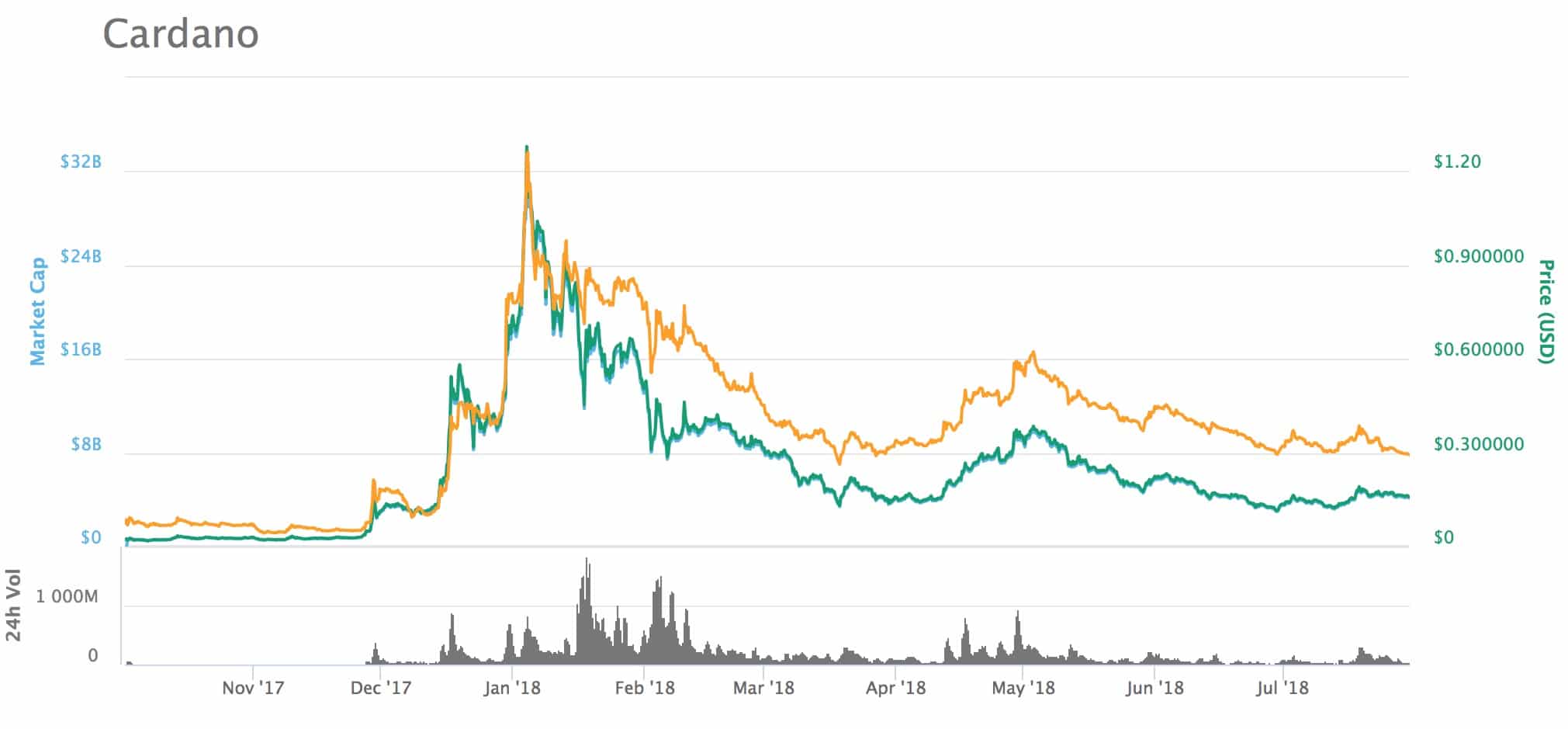

Indeed, Cardano quickly rose to worldwide renown after its public launch in October of 2017. Initially worth roughly $0.02, Cardano’s native token, ADA, had reached a peak of nearly $1.30 by early January of 2018. The cryptocurrency quickly rose up the ranks of CoinMarketCap, at times placing as the fifth largest cryptocurrency in the world.

Things have since cooled off considerably for Cardano–ADA has not been spared from the massive haircut that has caused crypto markets to shed billions over the last several months. At the time of writing, a single ADA token was worth roughly $0.13; Cardano sat comfortably as the world’s eighth largest cryptocurrency by market cap.

Still, the network is being hailed as one of the most promising projects in the cryptosphere. Mati Greenspan, Senior Market Analyst at eToro, delved into Cardano at more depth. This included a technical background, future developments for the project, as well as a token valuation analysis.

Cardano Was Created as a Backbone for an Ecosystem of Decentralized Applications

It can be argued that Cardano was intended to act as a sort of improved version of the Ethereum blockchain–both networks have been built to act as the backbone for an ecosystem of ‘dapps’ (decentralized applications).

However, there are some important differences between the two networks. Cardano boasts that its platform is the first to use an academically peer-reviewed open source protocol. Cardano’s protocol was also constructed in layers that allegedly “[give] the system the flexibility to be more easily maintained and allow for upgrades by way of soft forks”–one layer that will host ADA transactions, and one layer that will host Cardano’s dapp and smart contract ecosystem.

Suggested articles

OctaFX Makes It Easier to Get Autochartist Tools for Smarter TradingGo to article >>

Source: CoinMarketCap

Source: CoinMarketCap

Cardano is reportedly capable of processing hundreds of transactions per second, compared to Ethereum’s 4-7 transactions per second.

Still, Ethereum boasts a wider user base and a higher market cap than Cardano has come close to having. Especially now that blockchain networks seeking to serve a similar purpose, like TRON and EOS, have appeared on the scene, Cardano has a ways to go before it could surpass Ethereum.

Ethereum and Cardano Share an Important Figure: Meet Charles Hoskinson

Why do Ethereum and Cardano have so much in common? Cardano was created by Charles Hoskinson, one of the eight original co-founders of the Ethereum network.

Hoskinson left Ethereum in 2014 after becoming embroiled in disagreements about how the project should be structured – according to Forbes, Hoskinson wanted to open Ethereum to become a for-profit entity with a formal governance structure; Vitalik Buterin, Ethereum’s original founder, wanted to maintain the network’s status as an open-source nonprofit with a decentralized governance structure.

After leaving Ethereum, Hoskinson joined forces with Ethereum’s Jeremy Wood to create IOHK, an engineering firm that builds blockchains and cryptocurrencies for private companies and public institutions.

Thus, Cardano was born–the network was IOHK’s primary project. The network was created as a public blockchain network with smart contract capabilities, powered by ADA, its native cryptocurrency.

In an exclusive interview with Finance Magnates conducted earlier this year, Hoskinson told of his high hopes for the network’s future. He said that in a year, “[Cardano will [be able to–pound-for-pound–compete with Ethereum and Bitcoin.”

Financemagnates.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube