On Monday, the United States Department of the Treasury announced it will be “borrowing” a record $3 trillion to help support the American economy. The move comes after the Federal Reserve dished out over $6 trillion to private dealers before the first U.S. Covid-19 death, and the $1.5 trillion added to the nation’s debt since March 1.

The Treasury Takes Out $3 Trillion for the ‘Increase in Privately-Held Net Marketable Borrowing’

It seems the coronavirus outbreak is an ominous excuse to continue massive stimulus handouts. On Monday, May 4, 2020, the U.S. Treasury explained that it would “borrow” $3 trillion, in order to combat the economy distraught by the industry shutdowns. In addition to the borrowing of approximately $2.999 trillion, the Treasury also plans to backstop a number of lending schemes for the central bank. The Treasury has been working in lockstep with the Federal Reserve during the last two months with the various stimulus programs like the CARES Act.

“The increase in privately-held net marketable borrowing is primarily driven by the impact of the COVID-19 outbreak, including expenditures from new legislation to assist individuals and businesses, changes to tax receipts including the deferral of individual and business taxes from April – June until July, and an increase in the assumed end-of-June Treasury cash balance,” the department revealed in a statement published on Monday.

The move comes after the massive amounts of fiat distributed to financial partners before the wake of the coronavirus outbreak. Prior to the first U.S. SARS-Covid-19 death, the Federal Reserve handed out over $6 trillion to private dealers. By mid-March the Federal Reserve used its financial bazookas giving special powers to Blackrock, making it so megabanks don’t need to prove deposits held in reserves, and assisting the Treasury with the “historical” stimulus package. Mainstream media lauded the CARES Act as one of the “most far-reaching measures” ever, as it tacked on over $1.5 trillion onto the nation’s debt. At the time of publication, America’s debt is roughly $24.9 trillion and the Treasury needs more money after the $3 trillion dollar loan.

‘Nobody Gets to Fail’ – The U.S. Treasury Anticipates Borrowing Another $677 Billion in Q3

The Treasury noted that Q1 borrowing was around $477 billion and the entity expects to add another $677 billion during the Q3 2020. Sven Henrich, the market analyst from northmantrader.com, has been speaking on the Federal Reserve and Treasury’s moves for quite some time. “Imagine a casino where whenever the high rollers lose all their chips at the poker table the casino just gives them new chips for free,” Henrich tweeted on Monday. “That’s the Fed now. Nobody gets to fail, nobody gets to lose — the high rollers that is.” The analyst added:

The U.S. Treasury seeks to borrow a record $3 trillion this quarter. The Fed has printed $2.5 trillion this quarter. Soon you’re talking 30% of annual GDP in 1 quarter.

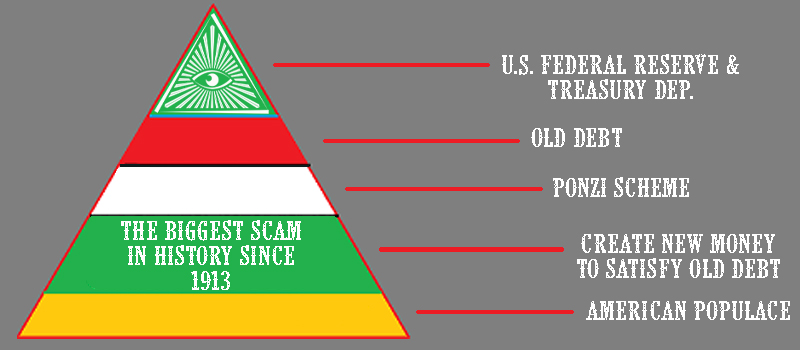

Most sound money economists and bitcoin proponents have always called the U.S. central bank for what it is worth — a Ponzi scheme. For instance, gold has been a safe-haven asset for millennia and it has prospered during the macroeconomic storms. Further, censorship-resistant assets like bitcoin are growing in value as well and speculators believe it is due to the faltering economy. With most of the U.S. government officials showing no end to the lockdown behaviors spread across nearly every state and the 30+ million unemployed Americans, it’s likely the Fed and Treasury will continue to create more fiat. It seems “too big to fail” will never be allowed to fail, as the pandemic was the perfect excuse to pull out all the stops.

What do you think about the Treasury borrowing $3 trillion? Let us know in the comments below.

The post US Treasury to ‘Borrow’ $3 Trillion for a Single Quarter – Anticipates Taking Billions More for Q3 appeared first on Bitcoin News.

Bitcoin.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube