Merged mining, or Auxiliary Proof-of-Work for the more technical crowd, is the process of mining two separate cryptocurrencies at the same time. Although not as popular as traditional Proof-of-Work or even Proof-of-Stake consensus algorithms, some projects have implemented merged mining to ‘piggyback’ off more secure networks as they grow.

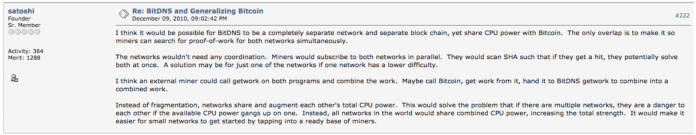

Although he didn’t include it in the Bitcoin whitepaper, Satoshi Nakamoto outlined a rough idea of merged mining in a Bitcointalk forum in 2009. Let’s look further into how this innovative mining works, what it means for the projects that implement it, and how you can take advantage as an investor.

Satoshi outlining an early form of merged mining

How does Merged Mining work?

Every merged mining implementation has an auxiliary chain and a more established parent chain. To work together, both chains must share the same hashing algorithm. We’re going to examine one of the most popular merged mining pairs, Namecoin and Bitcoin, to explain the process.

In this pair, Bitcoin is the parent chain while Namecoin is the auxiliary chain piggybacking off Bitcoin’s network. Both cryptocurrencies use the SHA-256 hashing algorithm for mining.

Implementation

Parent chain developers don’t need to perform any additional work to implement merged mining. Therefore, the Bitcoin network doesn’t even need to know that Namecoin is mining along with it.

Auxiliary chains, however, need some added development to integrate merged mining. Continuing our example, Namecoin developers updated the blockchain to accept proof of Bitcoin mining as valid on the Namecoin blockchain as well.

Merged Mining Process

Merged mining requires no additional computing power for the miners. As a miner, you mine Namecoin and Bitcoin just as efficiently as you would when mining only Bitcoin. You (or your mining pool) just need to perform the additional set-up to support it.

Here’s how it works:

You begin by assembling a block of transactions for each chain – Bitcoin and Namecoin in our example. The Namecoin (auxiliary chain) block includes what you’d expect in a standard set of transactions. The Bitcoin block also contains regular transactions. However, it has an additional transaction with the hash pointing to the Namecoin block you just constructed.

After assembling your blocks, you mine. There are a few different scenarios that could play out here:

- You mine a block at Bitcoin’s difficulty level. You finish creating the Bitcoin block and broadcast it to the Bitcoin network. Because the difficulty level at which you mined the Bitcoin block is higher than Namecoin’s difficulty level, you also mine a Namecoin block. You receive both mining rewards.

- You mine a block at Namecoin’s difficulty level. You finish assembling the Namecoin block by inserting the header and hash of the Bitcoin block. The Namecoin chain then accepts this block. It’s able to recognize the additional Bitcoin header and hash as your proof of work because of the development work you did to support merged mining. You only receive the Namecoin mining reward.

- You mine a block between Namecoin’s and Bitcoin’s difficulty level. You experience the same outcome as scenario number two.

Merged Mining Implications

The Good

Small and new blockchain projects have a few good reasons to integrate merged mining. Most importantly, doing so beefs up the security of their network while still being able to operate as a distinct chain. These auxiliary chains also gain exposure by being associated with a more popular blockchain.

Additionally, miner’s are heavily incentivized to participate as they receive extra income at no additional cost or power. And, because miners usually trade between the two coins to keep what they favor, there’s a boost in liquidity for both cryptos.

The Neutral

Parent chains fall victim to some blockchain bloat with the addition of auxiliary chains. The hashes that the auxiliary chain adds to the parent chain’s transaction tree are small, but they do take up space. As long as coins like Bitcoin are successful in implementing second-layer scaling solutions, this bloat shouldn’t become an issue.

The Bad

Unfortunately, it’s not all sunshine and rainbows. Integrating merged mining requires additional development work on the auxiliary chain. When switching over from another mining protocol to merged mining, you need to hard fork. Another hard fork is necessary if you ever want to switch away from merged mining.

Miners and mining pools also have some work to do if they want to reap the benefits of mining two chains. Although merged mining doesn’t require additional power, it does require more maintenance work. In mining two blockchains, you have twice the connections to serve and twice the distribution channels to maintain (if you run a mining pool). Some groups may not find the added upkeep worth the extra coin.

Investor Insights

Overall, merged mining provides more of an advantage to miners than it does to investors. However, when combined with other information, merged mining could be a telling sign of a promising project. Here are some past and future examples:

Namecoin – No Long-term Guarantees

Namecoin, effectively a decentralized domain registry, was the first coin to have merged mining with Bitcoin. Once a top 10 cryptocurrency by market cap, it’s dropped significantly to a spot in the high 200s. It serves as a great example of how a project can slowly fall by the wayside – even when tied to cryptocurrency’s most powerful network.

Previously the number three coin by market cap, Namecoin is no longer in top cryptocurrency discussions

Even though a significant number of mining pools support Namecoin merged mining, the coin hasn’t seen much adoption in its five-year history. Development is also not as active as similar projects. This fall from grace goes to show that just because a cryptocurrency includes merged mining that doesn’t necessarily mean the fundamentals warrant an investment.

Dogecoin – Immediate After Effects

Early in Dogecoin’s life, the community decided to integrate merged mining with Litecoin. They found that with the original mining mechanism in place, the network would run out of significant mining rewards within the year. With no changes, miners wouldn’t have an incentive to mine, and the network would be susceptible to a 51% attack.

Almost immediately after switching from Proof-of-Work to Auxiliary Proof-of-Work, the Dogecoin price rose from about $0.0002 (~0.00000041 BTC) to around $0.00047 (~0.00000115 BTC). That’s over a 180 percent increase in BTC price over just a couple of weeks.

Dogecoin experienced a significant price increase after implementing merged mining with Litecoin

Although just one data point, it shows that a project that switches to merged mining could be a profitable short-term investment. There are a few reasons why this may be true.

First, the additional network security brings immediate confidence to the community. Also, tethering to a more well-known coin provides more exposure to lesser-known cryptocurrencies. It’s like a quick marketing boost. Finally, merged mining adds liquidity to both chains as miners trade to keep the coins they prefer.

Elastos – Potential Sleeper Pick

Elastos is a blockchain-powered Internet that integrates merged mining with Bitcoin. With this coin still relatively unknown, it may be a solid pick up at this time. Once the platform is complete and merged mining is available, the Elastos price could see a similar rise to Dogecoin.

Additionally, Elastos is collaborating with NEO and Bitmain as the G3 of China. It’s rumored that Bitmain will dedicate a portion of the company’s hash power to mining Elastos. For those of you that don’t know, Bitmain controls some of the largest Bitcoin mining pools. So this support is a positive indicator for the Elastos price.

With this in mind, it seems as if the Elastos price should have firm upward pressure once mining begins. However, analyzing the project as a long-term (greater than one year) hold requires a deeper dive into the fundamentals.

Final Thoughts

Merged mining is an excellent option for young projects looking to grow without fear of a 51% attack. From an investment standpoint, a project’s decision to implement merged mining could cause an immediate jump in price. Although, this price boost may not last.

No matter how it affects the price, merged mining is something to be aware of as an investor, a miner, or even just a crypto enthusiast. With the ever-increasing threat of 51% attacks, switching to merged mining could very well be a trend that we start to see more of as we grow as an industry.

The post What is Merged Mining? Can You Mine Two Cryptos at the Same Time? appeared first on CoinCentral.

Coincentral.com is author of this content, TheBitcoinNews.com is is not responsible for the content of external sites.

Our Social Networks: Facebook Instagram Pinterest Reddit Telegram Twitter Youtube